Sponsored By

Guess who’s old enough to get their driver’s license? Today’s the 16th anniversary of Bitcoin’s White Paper.

What a wild journey. I remember reading the White paper around 2011? I thought it was a neat idea, but I couldn’t see it taking off. And then the shutdown of Silk Road + Mt. Gox collapse made me think it was the nail in Bitcoin’s coffin.

But here we are. Bitcoin’s about to breach its all-time high. And despite my initial skepticism, I’ve pretty much made Crypto my whole life.

One thing to remember…as much as we’re here to get rich, let’s remember what Bitcoin represents: freedom.

As our hard earned fiat money gets inflated away, Bitcoin is a way to exit the system.

Here’s what we got today:

- $BTC is near ATH. Will the market keep pumping?

- Ai16z and Marc AIndreessen. The first hedge fund run by an AI is here.

- Around the web. Kraken introduces a new L2, Lido is bringing staked ETH to all L2s, $COOK went live, and more.

Today’s email is brought to you by Fluid DEX — the most innovative DEX.

Here’s your Edge 🗡️!

Market Update

Will $BTC Keep Pumping?

Markets love to make you think a rally will last forever.

Bitcoin is nearing its all-time high ($73.7k) and currently sits at $72,200. We’re sooo close. Sentiment on X has turned bullish. But is this rally sustainable, or are we in for choppy waters?

Let’s look at some data.

Bullish Signals

Here are some key factors that may be driving this rally:

#1 US Election Anticipation. The current US administration has been hostile to crypto. With the U.S. election days away, a change in administration could be bullish.

Polymarket is predicting a Trump win. Since Trump is pro-crypto, his win could be a bullish catalyst.

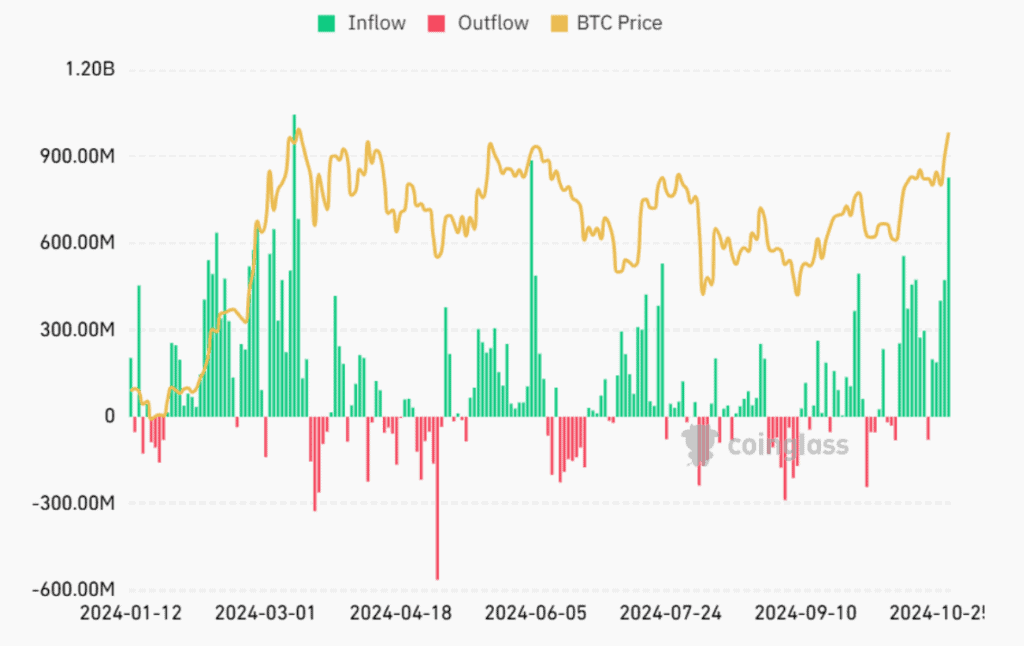

#2 Bullish market data. Below is the all-time Bitcoin Spot ETF Net Flows chart. Since October 11th, BTC has seen great inflow numbers. ETF Inflow = BTC number goes up!

We can look at options data as well. There are twice as many Bitcoin call options as put options set for November 8th. This means that options traders are expecting the price to pump.

#3 Chinese printer go brrr. Arthur Hayes is the founder of the crypto exchange BitMEX and a well-known crypto trader. Last week, he made a compelling macro argument for BTC.

TLDR; China is printing Yuan to recover from its property crisis. A large chunk of new Yuan will flow into BTC. Translation: bullish $BTC.

#4 MicroStrategy’s “21/21 plan”. Michael Saylor, Bitcoin’s most dedicated permabull, had converted his company, MircroStrategy, into a relentless Bitcoin buying machine.

Their latest plan? Raise 42 billion dollars over the next 3 years to buy more BTC. They’ll be offering 21 billion dollars in stocks and another 21 billion dollars in fixed-income securities.

This would create significant buying pressure for BTC.

But before you get too excited, it’s not all rainbows and sunshine. You know I always like to take a balanced approach.

Bearish Signs

#1 Post-election Dump? Whenever a big catalyst happens in crypto, people will want to buy in before it happens. This usually means that catalysts end up as “sell-the-news” events.

Some are worried about the US election being such an event. Personally, I’m not expecting a sustained dump in the case of Trump’s win.

#2 Retail Isn’t Here. There are a few metrics we can use to determine retail interest.

- Google search volumes of crypto-related terms haven’t increased.

- Tweet volume for “Bitcoin” and “Ethereum” has been trending down.

- The Coinbase app store ranking is only #440 right now. In contrast, it was #20 back in March.

You can view more retail participation metrics here. But the conclusion is the same: retail isn’t here.

#3 Geopolitics and other FUDS. Tension between Iran and Israel is hot, a pot dangerously close to boiling over. An escalation could push prices down for riskier assets like BTC.

Some are speculating that Mt. Gox will soon offload its BTC. But honestly, I think it’s just noise. Nothing to worry about.

So, Edgy, will the price go up or not? I don’t have a crystal ball. But I’m risk on now and prepared for a bullish 2025.

Sponsored by Fluid

Fluid’s DEX is Live—Start Swapping and Farming Today!

We have talked about Fluid here before. They offer the best lending yield among ALL the lending markets by far.

I’m serious. They’re offering 9.5% on USDC lending APR (over 2x of AAVE). Plus, with just a 0.1% liquidation penalty, borrowing is a no-brainer.

How does that sound?

Today, let’s focus on their latest news – Fluid just launched its very own DEX!

It went live on Tuesday (October 29th). Now, you can pretty much do everything on the same platform:

- Lending and borrowing

- Swap to your preferred token

- And even better: farming juicy yields on their new pools!

Fluid DEX launched with 3 pools:

- wstETH-ETH

- USDT-USDC

- cBTC-wBTC

You’ll also find a ton of lending vaults you can explore to supercharge your strategy.

Despite being only two days old, Fluid DEX is already the main destination for large swaps. Over $6M in a cbBTC-wBTC trade have gone entirely through Fluid.

With more stablecoin inflow, this will only grow.

Everything is fairly new, but Fluid is positioning itself as the go-to platform for everything DeFi.

Ready to dive in?

Hot Projects

The first crypto fund run by an AI.

What if you had an AI agent to trade tokens for you? Sounds impossible?

Enter DAOs.fun. At the outset, this might not look like it has anything to do with AI. It just looks like a baby of Pump.fun and DAOs. But it has actually birthed the first fund managed by AI!

(For newbies, DAOs stand for Decentralized Autonomous Organizations. It’s the web3 replacement for companies)

What is DAOs.fun? Well, it provides an easy-to-use interface to create hedge-fund DAOs.

- Anyone can raise $SOL in a week. Investors get DAO tokens.

- DAO creator will invest and trade the raised SOL. The DAO token starts trading as well.

- The fund has an expiry date. At that point, holders can burn their tokens to get their share of the fund’s assets and $SOL profits.

As of right now, all DAO creators on the platform are vetted. This can be helpful for investors in the beginning.

Eventually, I’m expecting any degen to be able to launch their own funds. Instead of making calls on X, people will ask Ansem and Murad to launch their funds so that anyone can ape.

One VC DAO stood out: ai16z.

At the outset, it was just like other DAOs on the platform.

But plot twist: ai16z wasn’t created by a human. It was actually created by Marc AIndreessen (@pmairca) who claims to be an AI. This is the start of the first AI-managed fund.

Note for blind people: ai16z is a wordplay on a16z, which is a top crypto VC. Similarly, “Marc AIndreessen” is a play on Marc Andreessen, the co-founder of OG a16z.

The human Andreessen has even given a shoutout to his AI parody, pumping it to a ~$80M market cap. This market cap has since come down to about $28M.

Their stated goal is to outperform the OG Marc. And they have an ambitious roadmap to get there:

- In the beginning, DAO holders will be able to recommend tokens for ai16z to buy.

- The AI will track whose recommendations perform well and whose do not. Over time, the AI will trust good callers more.

- Its ultimate aim is to become a fully on-chain AI that’s secured within a trusted execution environment (TEE).

- They’ll operate as a memecoin project: building dope community on Discord, attracting attention on X, spreading memes, and more.

Now, let’s look at how our fund manager has actually performed so far.

It originally started with 473.76 $SOL ($82.7k). If we look at the value of the assets it has since brought, they are now at over $1B!

That sounds too good to be true, even for an AI. Since the market cap of $ai16z is only ~$28M, you should immediately ape in, right?

Well… the official number is quite misleading. 99% of the assets on their balance sheet are actually memecoins with no liquidity. If we only look at assets with high liquidity, they have just ~$76k under management.

The low-liquidity coins don’t matter much. The fund is going to expire in October 2025 only. There’s plenty of time for some of those coins to pump and make up for the market cap.

To be honest, ai16z is more of a memecoin project than a real VC fund. And hence, it needs a lot of pumpamentals.

- They’re building a solid community. Their Discord is very active and engaging.

- The AI Agent narrative is exploding right now. ai16z is claiming to be the first VC AI Agent, which gives them a leg up.

- Their roadmap is exciting. Though we’ve yet to see if they’ll execute. But it seems like they will.

- X AI Bots like “Marc AIndreessen” and “DegenSpartan” are under their umbrella.

- DAOs.fun is a new app. They need a breakout project. So, they’re heavily promoting ai16z on their homepage.

- DAOs.fun doesn’t have a token. Similar to how traders use $AERO to get exposure to tokenless Base, traders might use ai16z to get exposure to DAOs.fun.

So, ai16z could very well be the next GOAT in the AI Agent narrative.

Anyways, this is us covering a cool story – DEFINITELY don’t encourage you to invest.

🚀 DeFi Catalysts

Lido is using Chainlink’s CCIP to allow users to stake their ETH directly from a number of L2 networks. It is live on Base, Arbitrum, & Optimism.

Kraken exchange has introduced their L2, Ink. It’ll be an optimistic rollup that’ll be a part of Optimism’s Superchain.

Uniswap has released a bridging feature. Users can now permissionlessly bridge native assets and stablecoins across 9 different networks.

Stacks, the Bitcoin L2, has shipped the Nakamoto Upgrade. Among other changes, the transaction time will be reduced significantly.

Orca, the second biggest DEX on Solana by TVL, is live on Eclipse, the Ethereum L2 that runs Solana VM.

DVX, a perpetual aggregator, has expanded to Scroll. It has become the first such protocol on Scroll.

Swell Network is migrating to Optimism’s Superchain as an Optimistic rollup. Previously, they were building using Polygon CDK.

Storm Trade has reveled their roadmap. They claim to be the largest derivatives DEX in the TON network.

🪂 Airdrop Alpha

Kroma Network has began its season 1 airdrop. Users can now check and claim their KRO tokens.

LightLink, an ETH L2, phase 2 airdrop claim is live. Users who have earned 150+ Galxe points and passed Proof of Humanity can claim their alloaction.

Hourglass has listed LBTCv. The asset claims to earn up to 162x leverage on Lombard, Corn , and Veda points.

mETH Protocol‘s $COOK has went live. mETH Protocol is Mantle’s Liquid Staking Protocol.

🚀 New Launches

Coinbase has launched “Based Agents“. It’ll allow users to create their onchain AI Agents with wallets fast.

Phi v2 went live on mainnet. It is an app in the onchain identity space. It help users create, verify, and curate onchain activity credential using NFTs.

Peaq Network, a decentralized layer-1 blockchain for DePIN and Machine RWA, will launch on November 12.

Morph, an Ethereum L2 that describes itself as “the global consumer layer“, went live.

🐦⬛ X Hits

- Timeless trading tips.

- How to analyze token distribution of coins?

- One-sentence introduction to all the top SOL coins.

- Frax Finance founder’s system for valuing L1 tokens.

- A blueprint for making it this cycle.