You gotta train yourself to do the opposite of what feels comfortable.

This means…

• Buy before the crowd starts buying

• Sell before the crowd starts selling

• Hold and keep learning when they disappear

I’m buying now even though it’s painful – I’ll thank myself later.

Here’s what we got today:

- Arbitrum Grant program. How to farm the opportunity?

- Why is $BTC crashing? Looking into FUDs around Bitcoin.

- Around the web. Solana released Blinks, zkSync launched Elastic chain, Blast launched its token, and more.

Today’s email is brought to you by Everclear — the first clearing layer.

Here’s your Edge 🗡️!

The Latest Arbitrum Grant

There are so many L1s and L2s out there these days. It’s a war for attention, liquidity, and users.

So to incentivize people, sometimes the best thing to do is to give out some free money.

That’s what’s happening now over at Arbitrum. Arbitrum, one of the largest Ethereum L2s, recently launched a campaign worth 30M $ARB (~$25M USD).

Let’s take a quick look at some data and some thoughts to see if this Grant might make a difference. And we’ll also share some farms worth looking at.

Who’s Leading ETH Layer 2s?

The L2 space topped at around $45B. Arbitrum and Base are the top ones demonstrating consistent growth over the last three months.

Despite unfavorable market conditions, there are still APYs out there that are worth farming.

Volume and stablecoins play a massive role in deciding which opportunity to chase. Let’s compare Volume (green bars) and Stablecoins (Teal lines) for different L2s.

Arbitrum:

Base:

Optimism:

So, according to fundamental metrics, Arbitrum is leading the L2 race.

How is $ARB performing?

Let’s compare $ARB Performance from January 1st, 2024 with other majors.:

- BTC: 44.26%

- ETH: 47.37%

- SOL: 32.67%

- ARB: -51.61%

So, despite the improvement in fundamentals, the token has performed poorly since the start of the year.

But incentives are incentives. Even if $ARB isn’t pumping, it is home to juicy APYs.

Some Interesting Farms

I have listed some of the protocols I am farming, and some through which outstanding APY can be earned.

- Smilee Finance (Options Protocol)

Deposit into one of the incentivized vaults (mostly calls for the ETH/USDC vault).

Please remember that these vaults are sometimes unprofitable; always check the strike price from the provided charts. - Beefy (Yield Aggregator)

I always have a soft spot for Beefy since they’re the OG’s. They recently introduced their way of farming a Concentrated Liquidity Pool. These pools are all incentivized ->wstETH – ETH.

- Sommelier Finance (Yield Aggregator)

I mostly use the Real Yield ETH, but I also like the Real Yield USDC one if you have spare Stable.

- Pendle (Yield Trading)

A lot of Pendle PT pools are getting incentivized. I have been active in rsETH-ETH and ezETH-ETH, which have long expiration dates.

If you want to know which pools are receiving incentives, here’s the team’s dashboard.

Overall, Pendle has an excellent yield by itself, but having it boosted by the ARB Grant only makes it more compelling. - Contango (Leveraged Looping)

Most of the pools on Arbitrum are incentivized. I did keep an eye on wstETH from Aave V3.

- Across (Bridge)

Every time you bridge, you earn ARB rewards.

Did I miss something? We put a lot of effort into this type of content, so if you appreciate it and find it interesting, please do let us know.

As always, please execute rigorous due diligence when investing in protocols that imply additional layers to smart contract risks.

Everclear: Making Blockchain Simple

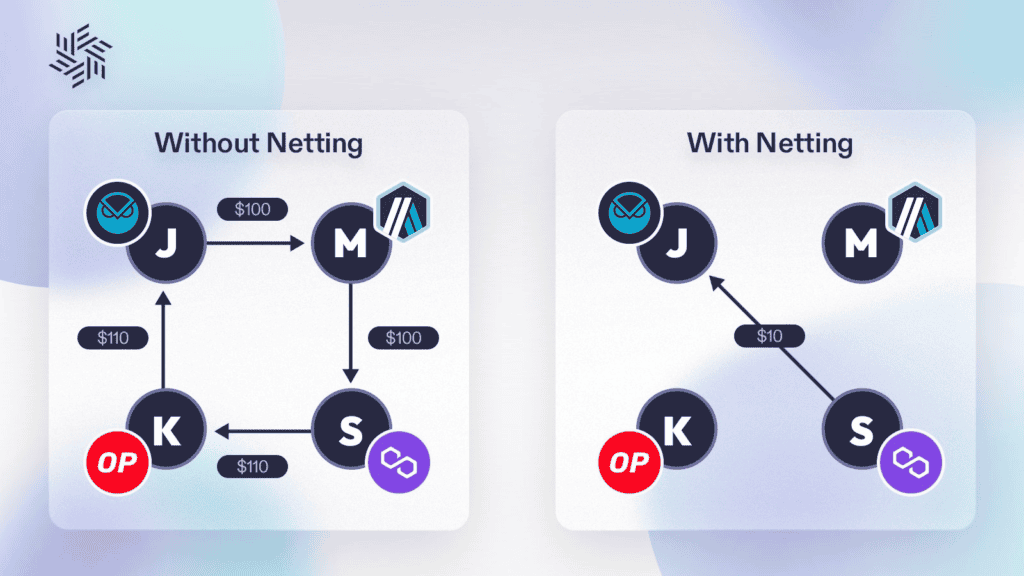

The blockchain is fragmented in the modular era.

Liquidity is spread thin. User experiences are complicated.

When you are dealing with so many fragmented chains, users need ways to easily onboard to new chains and access liquidity without worrying about new wallets, gas, or potentially losing bridged assets due to slippage.

That’s what excites me about Everclear.

Their recent upgrade makes blockchains user-friendly through Chain Abstraction and the Clearing Layer. Essentially, this allows users to use the blockchain without switching networks or buying new tokens for gas.

Think of it like a travel agency. You want to go on vacation, so the agency handles all the flights, hotels, and tours for you. Everclear does just this, but for cross-chain transactions.

Here’s why it’s better:

- Shared Liquidity. Uniswap and 1inch can now share liquidity, cutting costs.

- Token Issuers. New tokens are everywhere thanks to unified liquidity.

- New Chains. Access liquidity easily and simplify onboarding.

Start testing now! Everclear’s testnet is live, and the mainnet launches early Q3. $NEXT will be Everclear’s native token.

Compared to other sector giants like Axlr, Layer Zero, and Wormhole, $NEXT, at around $200M FDV, is a huge opportunity.

Imagine how high this might go after big catalysts, such as major exchange listings, start to fire.

We all want crypto to go mainstream. But to do that, it needs to be easier for everyone to use. That’s why Everclear is such a future-proof bet.

Join the First Clearing Layer →

Alright, Who’s Dumping $BTC?

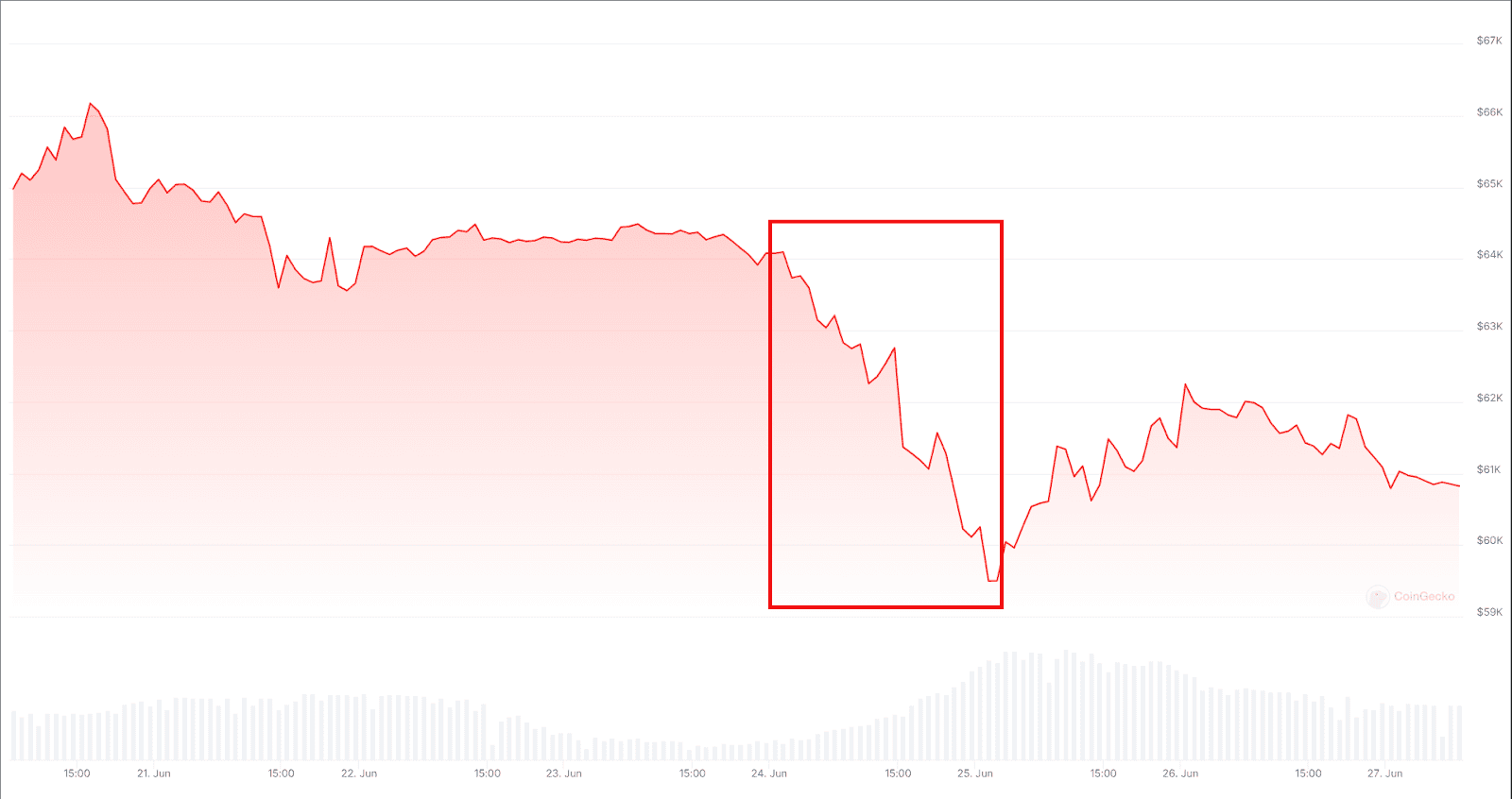

The above chart tracks the BTC price over the past seven days.

On June 24th, $BTC suddenly fell from ~$64k to ~$59.5k. And we’re still in the downtrend.

Naturally, everyone started guessing why. The main suspects? Mt. Gox repayment and the government dumping $BTC.

Let’s look at the reasons and if the prices will continue to fall.

FUD #1: The Mt. Gox Dumping

Mt. Gox is a canonical event in crypto history. If you haven’t heard of it, here’s the 80/20:

It was a Japanese crypto exchange that operated between 2010 and 2014. At its peak in 2014, it was handling around 70% of all the Bitcoin trading volume. Then came the plot twist.

In 2014, Mt. Gox announced it had lost almost 750k of its customers’ Bitcoins, and around 100k of its own Bitcoins, totaling around 7% of all Bitcoins.

Turns out, these Bitcoins were stolen from Mt. Gox’s hot wallet over time, starting as early as late 2011. The exchange went under, and a Trust was set up to repay creditors with the remaining Bitcoin and whatever else they could recover.

Fast forward to now: ~142k $BTC, ~143k $BCH, and nearly half a billion USD in fiat are waiting to be repaid.

On June 24th, the Mt. Gox Rehabilitation Trustee announced that they’ll start repaying creditors at the beginning of July. Here’s their press release.

That’s about 9 billion USD in Bitcoin hitting the market—equivalent to all BTC mined in the last six months.

According to the theory, $BTC whales freaked out and started selling off their holdings, leading to the price drop on June 24th. Some are still worried about this selling pressure.

FUD #2: The Government Dumping

The German Federal Criminal Police Office had seized around 50k $BTC from a film piracy website called Movie2k.to.

The German Government wallet can be tracked on Arkham Intelligence. Here’s the link for you:

Recently, they’ve been moving $BTC around, sending some to exchange addresses at Coinbase, Kraken, and Bitstamp. Out of the original 50k BTC, only 45,261 BTC is still with the German government.

Since everything is visible onchain, others are selling $BTC to front-run this dumping: It’s like rushing early to beat traffic — but everyone had the same idea and now everyone’s stuck in a worse jam.

Similarly, you can track the US government on Arkham Intelligence. In late 2022, they seized roughly 50,000 bitcoins related to the Silk Road website.

Yesterday, they also moved 3,940 $BTC to Coinbase Prime. These were originally seized from narcotics trafficker Banmeet Singh.

If the US govt also starts dumping BTC, it’ll push the price down. Tbh, It’ll kinda be like the doctor spreading germs in the hospital.

Edgy’s take

There are two sources of the current FUD: Mt. Gox FUD and the government selling FUD. I’m not really worried about the Mt. Gox selling pressure. Why?

- It’ll take time to complete all the transfers.

- Mt. Gox creditors could’ve chosen either BTC or Fiat. If they picked BTC, they likely want to hold it.

- Since they’ll only get a percentage of the $BTC they lost, they are not massively in profit to sell BTC.

As for the government selling FUD, it’s tricky. They’re definitely selling some BTC, and they’ve got a lot left.

If they start dumping everything, it’ll be a disaster. But I don’t have the crystal ball to predict what govt will do. Anyway, it’s probably going to be a source of FUD for now.

Short-term, I’m not bullish on $BTC. There’s too much negativity. Fortunately, I don’t trade short-term.

This is the time to revisit your core beliefs. Do you think $BTC is valuable long-term? Do you see it as digital gold? If so, the coming weeks might offer a big buying opportunity. Maybe it’s time to DCA into BTC.

🚀 DeFi Catalysts

BNB Chain is allocating $900K for liquidity pool support to boost meme projects in its ecosystem. Revenue generated from these LPs will reinvested.

Optimism introduced a new campaign called Superfest – the superchain DeFi festival. Users will be able to earn rewards.

zkSync introduced Elastic chain. It’ll be a network of interconnected zk-chains, similar to AggLayer from Polygon.

Roam, a DePIN project using DID to create a global WiFi network, is now live on the Solana dApp Store.

Jupiter introduced Jupiter Swap V3. It’ll use Metropolis liquidity backend to enable Instant Routing, Dynamic Slippage, Smart Token Filtering, and more

🪂 Airdrop Alpha

Blast L2 has launched the $BLAST token. Users have 30 days to claim Phase 1 airdrops. Blast App was released as part of phase 2 of the airdrop.

Rainbow Wallet introduced ETH rewards. They’re airdropping $ETH to the most active users every single week. They also have a points program.

EtherFi is discussing allocating 25M ETHFI tokens for Season 3 of the airdrop campaign.

Shardeum, an EVM-based L1 that uses dynamic state sharding, launched its incentivized testnet. You can earn XP, badges, NFTs & $SHM airdrop.

Sanctum launched Sanctum Profiles. It’ll be a criterion for their upcoming $CLOUD launch.

🚀 New Launches

DEXScreener launched Moonshot. It is a platform similar to Pumpdotfun that allows you to launch tokens easily.

Stable Jack has officially launched in partnership with Trader Joe. Users can now mint $aUSD and $xAVAX.

Juice Finance launched Juice Pro. Users can now farm with 10x leverage across Particle & Wasabi and earn Juice season 3 points.

Opyn introduced Opyn Markets. They describe it as Uniswap for perps. The landing page will be live on July 1st.

Velantis will go live this summer with HOT AMM. Velantis will be a modular protocol for deploying customizable DEX modules.

Midas launched $mBasis, a yield-bearing token that uses a strategy similar to Ethena’s $sUSDe. Midas is an RWA protocol backed by Coinbase Ventures.

📰 Industry News

U.S. presidential election debate between Joe Biden and Donald Trump is today. The crypto policy of each candidate might come up today.

Light Protocol and Helius partnered to launch zk-compression. It’ll allow applications to scale on Solana.

Arbitrum launched Layer Leap. It’ll allow users to skip L2s and bridge directly from Ethereum L1 to an L3 Orbit chain.

🐦⬛ X Hits

- Steph YT opportunities on Pendle.

- Pentoshi on the upcoming ETH ETF.

- New innovations are being developed on Solana.

- How to sell ETH to TradFi people.

- ETH ETPs estimates.

🛠️ Tech Tides: Blinks

What if you could swap tokens from X/Twitter?

Drumroll, please… Now that’s possible. Solana Labs introduced Blinks yesterday. And it’s even better.

What is Blinks? It is a new primitive that converts any Solana onchain action into a shareable link. These links can be shared everywhere, from DMs to social media. Users can swap, trade, stake, or do any onchain action by just clicking that link.

This will massively improve user experience. Want some $USDC from your buddy? Just sent him a URL. Apps devs will be able to embed onchain actions in a clean UX.

Right now, sharing blink URLs on Twitter can create an intuitive box for the onchain action. This is rendered by wallets from your browser. Right now, this feature isn’t available for other sites like Facebook.

Some are afraid that blinks will increase the risk of wallet drainers. Imo, this fear is overblown. We should be able to mitigate it by transaction simulation.

This is how we take crypto mainstream.

Until next time,

Edgy.