Can you smell it? Euphoria’s coming soon.

BTC’s pumping so hard that Coinbase went down yesterday. Brace yourself – we’re only in the 2nd inning.

Here’s what we got today:

- The bullish turn. Explaining this week’s pump.

- Best time to sell Airdrops? See what CoinGecko’s research says.

- Getting more EigenLayer points. 2 strategies.

- Around the Web. Uniswap fee switch, Lending contract for $crvUSD, Blast mainnet, and more.

Today’s email is brought to you by ZKX — a perp platform for degens.

Here’s your Edge 🗡️!

The Bullish Turn.

After several days of calmness, the kraken has been released.

- On Monday, $BTC was at $51k. By Wednesday, it crossed $62k.

- Ethereum was only ~$3k on Monday. Right now, it is trading at ~$3.4k.

- The total crypto market cap rose from $2.19 trillion on Monday to $2.31 trillion.

What’s going on?

#1 Institutions are buying. I’ve said BTC spot ETFs are the door for institutional money to invest in Bitcoin. And now, the institutions are rushing in through the door.

Bitcoin ETFs have almost reached 50% of the size of the Gold ETFs. Even yesterday, there was a net flow of $520 million into BTC ETFs. Fidelity increased its allocation from 1% → 3%. And so on.

#2 Leverage in the market. I have explained how leverage can cause the price to dump several times. A similar phenomenon can lead to price pumping.

Many are talking about the Gamma squeeze. In this case, market makers are forced to buy more BTC. Here’s a simplified explanation:

- Traders buy options.

- Market makers buy BTC to keep portfolios neutral.

- BTC Price goes up..

- Market makers are forced to buy BTC again.

- And so on.

There are many more factors contributing to the pump. Like BTC halving, ETH ETF speculations, Dencun upgrade, etc. But the above two are the most important.

I’ve been saying that the bull market is already here. What’s interesting is the severe lack of retail interest.

I anticipate more “normies” returning as soon as BTC breaks its ATH, and it’s everywhere on the news.

Buckle up.

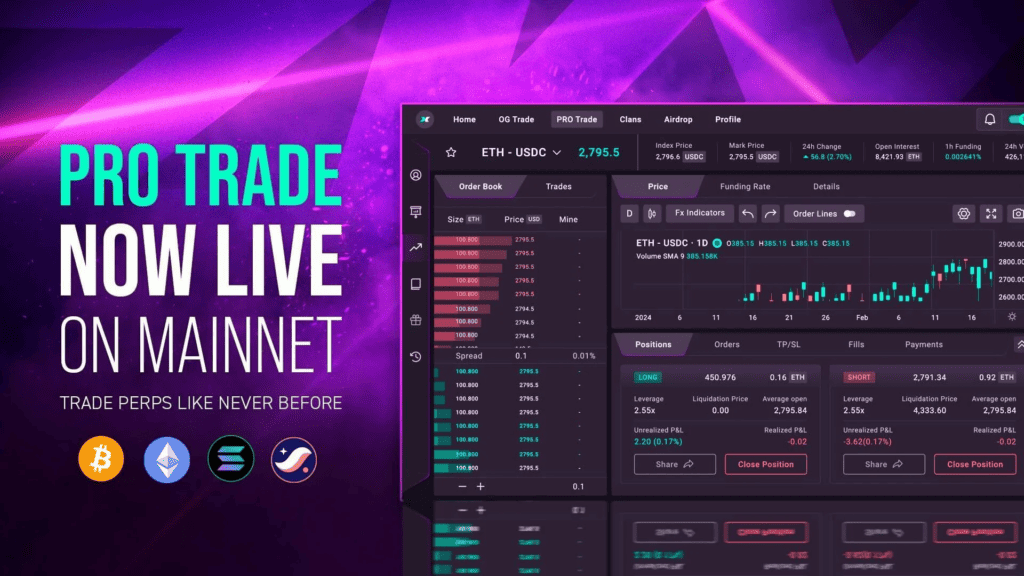

ZKX Pro Trade: Advanced Perp Platform for Degens

Ever wanted a top-tier terminal for crypto perp trading? Well… you might be looking for Pro Trade from ZKX.

What is ZKX? It’s the OG perp exchange on Starknet and comes with a unique architecture featuring an appchain, a self-custodial account, and a bridge-starkway. Enjoy gas fee-free trading, a single order book, instant transaction settlement, and faster execution all in one place.

ZKX has two exchanges tailored to different groups. The first exchange, OG Trade, is perfect for short-term traders and scalpers who enjoy a bit of gamification.

Last week, ZKX released their second exchange, Pro Trade. This is an advanced trading terminal with top features, including:

- CEX-like, intuitive UI

- Highly performant public APIs for automated traders

- Many types of orders: limit, market, take profit limit, take profit market, stop loss limit, and stop-loss market

- A cross-margin mechanism for trading strategies

Further improvements, such as more advanced order functionalities and new perp listings, are already on the roadmap. ZKX is trying to be the new perp trading home.

Traders on Pro Trade stand to earn both $ZKX and $STRK token rewards. If you would like to pick up some of those, head to.

When to sell your airdrop?

This cycle leading meta is airdrop farming.

Coingecko recently released a report on airdrops. They analyzed airdrops from January 2020 to February 2024. Here are the actionable takeaways from the study:

If you want to sell an airdrop, the best time to sell an airdrop is probably within the first 14 days. 23 out of the top 50 airdrops reached peak price within the first 14 days.

- Jito’s peak was on Day 2

- Dymension’s peak was on Day 10.

A caveat: the above insight isn’t a scientific law. It is just a rule of thumb. Use it if you don’t want to spend hours timing the sale.

But don’t sell within the first 14 days if you believe in a project. ATH of the remaining 27 (of the top 50) airdrops varies a lot. Optimism took 1.6 years to reach ATH.

Market conditions are the biggest factor in prices. 19 airdrops (38%) reached ATH in 2021, the peak year of the last cycle. These included airdrops launched in 2020 as well as 2021.

11 airdrops reached ATH in 2022. These airdrops were launched in the same year only. They reached ATH soon after the launch and trended down.

The remaining 21 airdrops peaked during 2023 and 2024.

These peaks happened in the current bullish sentiment, starting from the BTC ETF speculations. And they didn’t hit ATH very fast. Generally, they kept trending up for a much longer time.

The takeaway is simple: hold in bull and sell in bear.

If you want to read the original study, here’s your link.

Getting More Eigenlayer Points

EigenLayer is perhaps the most anticipated airdrop right now. The best guess is roughly at the end of Q1 or Q2 2024.

We’re going to share a few advanced strategies so you can increase the probability of getting airdrops.

Risks to consider:

- These strategies leverage your current liquidity, which comes with a degree of risk.

- Most strategies revolve around looping. This involves paying interest on your looped asset to earn additional points.

- Based on the above, it is highly recommended that you forecast your ROI before opening a new position.

- Always watch your LRT peg for the asset you are looping.

- Smart contract risks

Ideally, you want to implement the following strategies if you are already farming Eigenpoints.

Easy + Moderate risk strategy

Loop into Silo to earn Ether.fi + EigenPoints

Silo finance is a lending market with isolated pools on Ethereum and Arbitrum.

Looping can be made in the following pool. Follow these steps:

- Deposit weETH

- Borrow ETH

- Swap ETH for weETH (on any aggregator available)

- Deposit weETH

- Keep looping.

Keep a safe LTV and always keep an eye on the peg.

Hard + Higher Risk Strategy

Leverage your weETH inside GearBox

Gearbox is a yield farming platform that offers composable leverage. This allows you to make a margin trade on mostly safer protocols (UniSwap, Curve, Lido, etc..).

The link to the strategy can be found here.

Here, you can leverage up to 9X of your weETH deposit.

Please always watch for the Health factor and your Liquidation Price.

I always keep a health factor above 2.2 to avoid liquidation risk.

If everything aligns with your risk profile, you should check your Borrow Rate next.

The above shows you what healthy leverage might look like.

Also, given the current pump, please note that the current borrow rate is insanely high.

We aim to show you that you can always squeeze more points from your assets.

If you want to learn more ongoing DeFi strategies, consider joining Double Your DeFi in April!

Final Note: Am I recommending that you guys leverage your assets to farm more airdrop points? Hell no.

Our team finds legit strategies, and we share them with you. And we do it in an objective way where we also cover the risks. Happy farming!

🪂 Airdrop Alpha

Parcl confirmed the $PARCL airdrop for March. We shared a strategy for Parcl airdrop a few weeks ago on this newsletter.

Ethena released details of Epoch 2 of their airdrop campaign. They have added rewards for depositing USDe into Pendle.

Zircuit, a zk-rollup, announced their points program. Users can now deposit Liquid Restaking Tokens of top LRT projects to Zircuit.

🚀 DeFi Catalysts

Uniswap team proposed an upgrade where fees from the protocol will be redirected to $UNI stakers.

Prisma Finance shipped $ULTRA. It’s a stablecoin backed by Liquid Restaked Tokens weETH, ezETH, & rsETH.

Across Protocol introduced their v3. It includes new features such as the cross-chain intents settlement layer.

SushiSwap introduced Sushi Bonds. It’s an alternative to traditional liquidity mining. It converts bonds into Protocol Owned Liquidity.

MarginFi introduced $YBX, an overcollateralized stablecoin that will capture Solana staking yield and MEV tips.

Blast will launch their mainnet today. Over $2 billion in TVL locked up on their chain will now be unlocked.

GMX is discussing new products and features for 2024. Ideas include GMX Bridge, GMX Chain, and PvP AMM.

Dopex had rebranded to Stryke. It has a new token model (SYK) for enhanced governance and cross-chain functionality.

Curve Finance deployed lending contracts for $crvUSD. The official launch hasn’t happened, but you can already lend and borrow.

📰 Industry News

Arbitrum introduced the Arbitrum Arcade campaign. It’ll be an 8-week onchain gameathon where 24 Arbitrum games will be introduced.

Lens Protocol is now permissionless. The web3 social media protocol is now open for everyone to join.

Uniswap introduced the ability to Limit Order via the Uniswap web app. This will be a valuable service for DEX traders.

Avalanche suffered a major outage last Friday. It failed to produce blocks for more than 4 hours.

🧠 Twitter Alpha

- Insane LRT growth over the past 30 days.

- Upcoming Dencun upgrade.

- Monster volume on $IBIT.

- Despite the market peaking, bitcoin searches remain steady.

- BTC (ETF) allocation thesis from Danny Marques