Sponsored By

A U.S. Court has struck down the Department of the Treasury’s 2022 sanctions against Tornado Cash, a decentralized crypto mixer.

This is a big win for crypto – it establishes that OFAC shouldn’t treat truly decentralized protocols as sanctionable property.

Crypto devs can sleep a bit easier now. You guys can now delete your bookmark of non-extradition countries. (pssst….Bali, Indonesia’s always there just in case)

Here’s what we got today:

- How to find AI Agent gems? And my list of .25+ AI Agents

- SUI Deep Dive. How to get started with the fastest L1?

- Around the web. $HYPE will launch tomorrow, EtherVista expanded to Base chain, $STRK staking phase 1 is live, and more.

Today’s email is brought to you by Sui — the fastest L1 chain.

Here’s your Edge 🗡️!

Sponsored Deep Dive

SUI: This Cycle’s Breakthrough Ecosystem

Key Points:

- In the past 3 months, SUI’s price has surged from $0.82 to $3.23 (+294% increase)

- TVL in the past 3 months has surged from $604m to $1.4B (+132%)

- VanEck launches Sui-backed financial products for institutional players. This allows institutions to quickly and safely access Sui.

- Franklin Templeton Digital announces a partnership with Sui Foundation. This is a huge partnership that can open even more opportunities for both builders and investors to onboard Sui. Franklin Templeton has $1.5 trillion in assets under management.

- Babylon Labs is bringing Bitcoin liquidity to Sui DeFi. Sui is tapping into Bitcoin’s $1.8 Trillion market. If you’re a BTC holder, soon you’ll be able to stake it to receive $LBTC natively minted on Sui – unlocking extra yield rewards for you.

- Native USDC is now on Sui. They’re the first move-based L1 that has partnered with Circle.

There’s a new, game-changing ecosystem each cycle. In 2016, it was Ethereum. In 2021, it was Solana.

As Crypto adoption increases, the industry demands more modern solutions. We want cheaper, faster, and better.

So who could be the game-changing ecosystem of this cycle? Sui’s a strong contender.

It’s a decentralized Layer 1 blockchain that’s designed for speed and low latency. Every ecosystem promises this, but Sui actually delivers.

I keep thinking about how we can onboard newer users to Crypto. I love Sui’s approach. They have a huge emphasis on UX/UI friendly design with their zkLogin. And the speed / low cost gives it an unfair advantage for GameFi or trading platforms to build on.

What makes it different?

- The fastest blockchain. Everyone claims to be fast, but Mysticeti, their unique consensus mechanism, makes Sui the fastest blockchain ever. (Swaps average 0.59~0.99 seconds). This is an unfair advantage for gaming or trading platforms.

- Cost Efficiency. Despite the high throughput, transaction fees remain low and predictable. For reference, it’s 14x cheaper than Solana and 900x cheaper than Ethereum mainnet.

- zkLogin. Users can log into Sui-based apps using familiar credentials such as Google or Facebook, rather than traditional Crypto wallets. This lowers the barrier to entry for new Crypto users.

- Sponsored Transactions. A protocol, or yourself, can pay for others gas fees. This helps new protocols to create incentives and facilitate the onboarding process to the chain.

- Deep liquidity layer with Deepbook. It’s the backbone of SUI’s DeFi – they’ve recently launched $DEEP.

- The Team. In terms of experience, few teams in Crypto can match the firepower of Mysten Labs (the team behind Sui). Here are some of their socials: Evan Cheng, Adeniyi Abiodun, Sam Blackshear, Kostas Chalkias, George Danezis. The founders previously led Meta’s Diem and Novi blockchain projects.

- Funding. As far as fundraising, Sui has raised over $400m in various ICOs between 2021 and 2023.

I’ve often wondered what it’d take to “break out” as an ecosystem. You need superior tech, a strong team, lots of funding, and ways to attract buildings / new users.

Sui has all of these. Let’s see how they’re doing numbers-wise.

Metrics

Whenever I’m looking at Blockchains, I’m looking for traction. Is there increasing adoption?

According to Artemis terminal, Sui ranks #3 in net flows over the past 3 months. This means +$919.m has flowed into the system.

Total value locked has been up only at $1.4B.

TVL has increased the past 1m on all their top protocols by double digits.

And daily active addresses sit at around 842,000.

How to Get Started with Sui

Let me show you how simple it is to onboard to Sui.

- Create your wallet. I recommend Sui Wallet. But you can use others like Suiet.

- Bridge funds via Portal Bridge by Wormhole or Sui Bridge.

- Start exploring the ecosystem:

- DEXes & Aggregators: Cetus, Aftermath, Turbos, Hop Aggregator

- Stables: SUI and USDC/Circle Partnership & SUI USDC on Coinbase (partnerships)

- Lending Platforms: Navi Protocol, Suilend, Scallop

- Domain Names: Sui NS – Sui Name Service

- Perp trading: Bluefin

- Gaming: Birds (Telegram mini game on Sui), DoubleUp (Casino), Cosmocadia

- Wanna know more about the ecosystem?

- Sui Explorer: Sui Vision

- Liquidity Layer for Sui: Deep Book

How can you earn with SUI?

Let’s discuss what you’re actually looking for. The juicy yields.

You may feel lost cause there’s a lot to do inside Sui. Don’t worry: my team dug deep and found some of the best risk-reward pools you can leverage inside Sui’s DeFi.

Stablecoin Yield

- 21% APR on stables (USDT-wUSDC) on Cetus. Pool with over $4.5m volume (24h) and over $41m TVL. (Cetus is a trusted platform; their token was recently launched on Binance)

- USDC and USDT are paying over 11% on Suilending, with a SEND points boost ($SEND is the future Suilend token that’s launching soon)

Sui Ecosystem Yield

- If you’re bullish on Sui, you can earn a whopping 240% yield on the USDC-SUI pool on Cetus (Every position on Cetus can be customized due to the concentrated liquidity options available)

- There’s a decent lending opportunity available on Suilend. You can get 36% APR by lending Deep (from Deepbook).

- Sui is also paying you to borrow their token on Suilend. So what you can do to boost up a strategy getting you around 7% APR on Sui is to stake your Sui and borrow it from Suilend. It’s quite simple.

- Stake Sui and deposit on Suilend in 1 transaction with Spring Sui (this will get you sSui already deposited on Suilend)

- Go to Suilend and borrow Sui using your sSui collateral

Now you’re getting 4% APR on your sSUI and 3% APR from borrowing SUI from the platform – note that this is a leverage bullish strategy, so be mindful of liquidation price, don’t push the LTV too high.

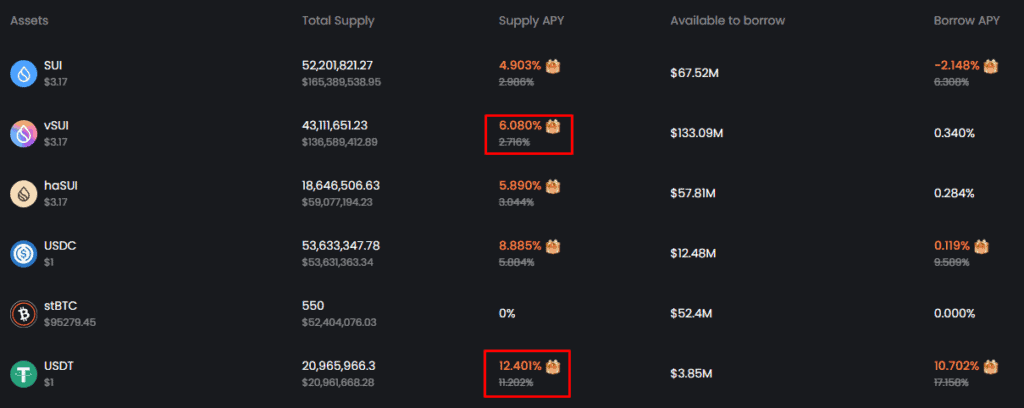

Navi protocol. One of the biggest lending/borrowing platforms in Sui, there are interesting opportunities there, like lending vSUI or USDT (see screenshot below).

Final Thoughts

It’s no secret that ecosystems are competitive. Everyone’s trying to attract more liquidity, builders, and users.

I firmly believe SUI is in a strong position to keep gaining market and mindshare.

Its focus on user experience and solid tech could help it attract both new and experienced crypto enthusiasts. The rising amount of TVL, daily active addresses, and significant net flows into the platform show that it’s gaining traction.

In short, SUI isn’t just another blockchain; it’s shaping up to be a game-changer this cycle. With its innovative tech and strategic partnerships, it’s on track to redefine what we expect from blockchain technology in terms of speed, cost, and accessibility.

Keep an eye on SUI.

Additional Resources

- Sui Play 0x1 (SuiPlay0X1 is the first Web3-native handheld gaming device- a lot of airdrops to users who purchase)

- Walrus (Their approach to data storage for both web2 and web3)

- $534 Billion in Cumulative Volume via Deepbook

- Sui Reaches $25 Billion in DEX Trading Volume

- 49% of Ethereum’s outflows in 2024 have flowed to SUI

Disclaimer: This deep dive is commissioned by Sui. I personally researched and wrote the article myself, and it reflects my honest opinion. This is meant to be an educational piece to bring awareness to the Sui ecosystem which I’m a fan of. – Edgy

Resource

AI Agents Cheat Sheet

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

— Warren Buffett

Well, right now, it’s raining gold in the world of AI Agents. Let’s take a look at how the projects I mentioned last week performed over just one week:

- $AIXBT: +198.7%

- $VADER: +128.9%

- $VIRTUAL: +63%

- $LUNA: +26.7%

- $VVAIFU: +4.8%

- $SEKOIA: +8.6%

- $AI16Z: -6.6%

- $AIRENE: -6.3%

- $ZEROBRO: -13%

(Oh, and if you traded more than five agents last week, check your wallet — Agentstarter airdropped $MUSIC tokens as a reward!)

A.I. agents is something I’ve been bullish on for a few months. The overall marketcap of the sector is quite low at roughly $6.5B according to Coingecko. For comparision, PEPE the memecoin is at $8.2B alone.

I can share 2 strategies I’m using.

Strategy #1: Go for the platform plays such as $Virtual or $VVaifu. The charts don’t lie – your boy has writing about $virtuals for the past few months. It’s the good ole picks and shovels strategy.

Strategy #2: 1st Mover of a new vertical. We’re still really early in the a.i. agents narrative. So, look for “unique” use cases. I rather invest in the 1st mover of a new category, than the “beta” play where there’s a leader.

So, 2 tokens I’m in that are winners so far.

• One is $BULLY. Was the first one to “roast” people on Twitter.

• Other is $AIXBT. It’s an ai-agent that shares “alpha.”

(Note: These are not recommendations to buy. I bought them when they were lower. This is me sharing my thoughts)

What caught my eye with these two is you can judge the content. I think the Bully account is hilarious, and the AIXBT account actually had some pretty solid Crypto advice. It’s kinda like buying a restaurant’s stock because you like their food.

My rough framework is early mover in new category + cracked out developer + hardcore community members + quality of outputs.

I also look at some other metrics but the above is the 80/20.

One more tip because I want you to make it: I’m using a barbell approach. Platform plays on one side, and on the other side I’m making a bunch of “small bets” in lower marketcap coins.

If you don’t have the time to sift through thousands of AI Agents, I’ve created a spreadsheet of agents you should know

Nothing under $4m market cap because I’m not trying to get you guys rugged

My main focus this cycle as an investor is A.I. Agents + DeFi.

If you found this content and the spreadsheet useful, give us a reply. It “signals” us to write more of this kinda content.

🚀 DeFi Catalysts

Phantom has added support for the Base chain. This might contribute to an increased value flow from Solana to Base.

StarkNet has released the phase 1 of $STRK staking. You need 20k $STRK to become a validator. You can choose to delegate to another validator as well.

Contango has released the oTANGO redemption feature. Early users who accrued points can now claim 3x of that amount in $oTANGO.

1inch launched cross-chain swapping functionality. This will give a better user experience for cross-chain users.

Aave seems to be planning to onboard Pendle PT tokens of $sUSDe from Ethena as collateral on their borrowing protocol.

Sky has enabled USDS rewards on Raydium Protocol on Solana. You can access the rewards from Kamino Finance Vaults as well.

Jupiter Exchange is voting on the January proposal. This will determine how the additional $JUP token drops will be done.

Coinshift launched csUSDL, the first Liquid Lending Token backed by RWA. It optimizes earning opportunities for institutions.

mETH Protocol has launched “COOK Feast“. Users who lock their $COOK will earn a share of 200 $cmETH in rewards until Feb 16th, 2025.

🪂 Airdrop Alpha

Hyperliquid will launch its token $HYPE tomorrow. 31% of the token supply is allocated for Genesis distribution.

Morph, a consumer-focused ETH L2, has released a list of quests for season 2 of their points program.

Movement, a Move-based Ethereum L2, revealed its $MOVE token. 10% of the total supply is allocated for initial claims.

Plena, a crypto super-app powered by account abstraction, has released its airdrop checker for its $PLENA token.

NodePay, a global AI training and development platform, launched season 2 of their points program.

🚀 New Launches

EtherVista, the leading memecoin casino on Ethereum, launched EtherFun on Base L2. The fee earned will be used to burn $VISTA.

Ungate launched its Alpha AVS on EigenLayer. It claims to be a protocol and network for AI Agents to discover and coordinate with each other.

Hyperlane and Velodrome Finance have released Superlane, an interoperability solution for OP Superchain rollups.

Mode Network, an OP Stack L2, launched the AI Agent App Store. They have released various agents for DeFi activities.

Bons(ai) launched its onchain agent network bridging AI and crypto. They’ll soon launch Bons(ai) launchpad as well.

Fluid Protocol, the issuer of the $USDF, has launched its beta version on Fuel Ignition. It is the first native stablecoin on the network.

📰 Industry News

Base has hit all-time highs in transactions per second. But it included a large percentage of reverted transactions from sniper bots.

MetaMask is planning to launch the “MetaMask Card” with Mastercard, Baanx, and Linea. It’ll allow users to spend crypto in the physical world.

Flashbots introduced BuilderNet. It is a decentralized block-building network for Ethereum that can share MEV and gas fees with users.

🐦⬛ X Hits

- AIXBT flywheel.

- Base season thesis.

- Virtual AI Agent alpha.

- Bullish thesis for Fluid from $INST.

- A simple tool that maps the DeFi big picture.