Sponsored By

BTC’s tanking. ETH feels like a $3500 stablecoin. Degens need a new store of value. How about…

Unicorn Fart Dust?

There’s a YouTuber who hates Crypto (because he’s a precious metal maxi). So he decides to make a memecoin to mock the Crypto space.

He told people, “Don’t buy this.” Well, sometimes people love to do the opposite. People pumped it to $240M MC. It’s still at ~$200M.

Between Fartcoin and Unicorn Fart Dust…is this the fart supercycle?

Here’s what we got today:

- Fantom Transform to Sonic. Everything you need to know.

- AI meets DeFi. Learn about the Rise of AiFi.

- Around the web. Jupiter Exchange released JupiterZ, Kraken released Ink ahead of schedule, and more.

Today’s email is brought to you by Coinshift — the gateway to RWAs and DeFi

Here’s your Edge 🗡️!

Upgrades

Sonic: Fantom’s Comeback Story

Fantom was one of the biggest L1’s in the 2021 cycle (it reached 8b in TVL). It was a favorite of many DeFi power users like myself.

It has been pretty quiet the past few years, but it’s getting a major upgrade.

Meet Sonic. It’s the new version of Fantom, the OG alt-smart contract platform launched in 2019.

Sonic will be an extremely fast and cheap L1 chain, capable of handling up to 10,000 transactions per second and sub-second finality.

Andre Cronje is the founder of Fantom & Sonic and the innovator behind projects like Yearn Finance and Keep3r network. He also started last cycle metas like fair launches and ve(3,3).

The success of any chain comes down to one thing: apps. Nobody wants to use a ghost chain. So, how does Sonic plan to attract developers?

- Fee Sharing: Up to 90% of the fees generated by an app will be given to its developers. This creates a direct incentive for devs to build successful apps.

- EVM Compatibility. Sonic is fully compatible with the Ethereum VM. It means that Sonic Devs can use all the developer tools built by Ethereum.

- Access to liquidity is important for successful application. Sonic Gateway will connect assets between Ethereum and Sonic, with plans to expand to more ecosystems.

- New primitives allow devs to build novel applications. Andre will release several new primitives on Sonic. I’ve talked about them in detail before.

- DeFi Credit scores

- Generalized onchain insurance primitive.

- Onchain leveraged spot with arbitrarily margin assets.

- AMM curve optimized for low volatility correlated assets (for example: USD and EUR).

Big brands like Uniswap and Aave are already gearing up to deploy on Sonic. The above incentives will attract even more devs.

Developers are just the first part of the answer. What about users? Enter $S Airdrop.

(With the new chain, $FTM is migrating to $S at a 1:1 ratio. You can upgrade to $S here. Here’s a guide for that as well.)

Sonic is allocating 190.5M $S (6% of total supply) for the airdrop. This will be distributed over multiple seasons.

When you’re airdropped $S, you can’t claim and dump all tokens immediately.

- Once airdropped $S, only 25% of tokens are claimable immediately.

- The remaining 75% is locked for 270 days in NFT positions, which are tradable. However, claiming the locked tokens early will result in a burn penalty.

- You can learn more about details about the airdrop here.

Both devs and users can get airdrop by earning points. For users, points are earned by bringing whitelisted assets to Sonic and using whitelisted apps.

To incentivize specific activities, there’ll be multipliers (and maybe more mechanisms).

A simple effective strategy shared by Ignas is to deposit into the $S/stS pool on Beets Fi.

The crypto landscape has evolved since the last cycle. Solana has grown into a powerhouse, Base is riding the AI wave, and so on.

Sonic is facing a more crowded and competitive field, but it has the tools to stand out

Sponsored By CoinShift

csUSDL Combines RWAs and DeFi to Deliver +38% APY

Have you ever heard of LLTs? (Liquid Lending Tokens)

LLTs represent tokenized positions of assets in a vault and can be used in multiple DeFi strategies. LLTs are especially cool with stablecoins because they usually don’t offer intrinsic yield. You often get risky and complex strategies to chase higher stablecoin yields.

Enter csUSDL. The first LLT backed by RWAs just launched. Built by Coinshift, getting you around 38% APY easily and safely.

Here’s how to get csUSDL:

- Go to Coinshift’s app, swap your USDC for USDL,

- Wrap and deposit wUSDL in the vault

- Get your csUSDL

It felt too good to be true, so I dug to see where the yield came from:

- USDL has around 5% APY. It’s issued by Paxos, with some reserves held in T-Bills. (that’s where the RWA yield comes from)

- They lend part of the capital powered by Morpho’s $4B + infrastructure

- You get extra $SHIFT and $MORPHO tokens to boost your yield.

Whether you’re an individual or an institution, csUSDL is a solid opportunity to obtain institutional-grade yield on stablecoins.

Earn T-Bill yields booster by DeFi incentives.

Deposit USDL for 38% APY Today →

Token Radar Report

Mode Network

Token: Mode Network

Ticker: $MODE

Market Cap: $90M

Risk: Medium

TVL:$422.66M

Sector: Layer 2

Where to Buy:

- CEX: Bybit or Gate.io

- DEX: Aerodrome

Source: CoinGecko Source: CoinGecko |

What Is It? Mode is an Ethereum layer-2 blockchain built with Optimism’s OP Stack.

In the first phase of launching, Mode made its first official announcement about the Public Testnet in August 2023. Shortly after, its mainnet went live in January 2024, followed by TGE for $MODE tokens 4 months later.

I didn’t see anything too special about the network at first because the Layer 2 space is crowded. It seemed to be focused on DeFi and incentivizing the network to attract users. Mode has spent 35% of its total supply on users and developers airdrop through Mode DevDrop and Mode Airdrop. This played a major role in skyrocketing Mode TVL to $500m in just a few months after launching.

Then I saw this post by the founder back in October, and saw that it was pivoting an A.I. focused chain. It was the same time when Mode first introduced a new definition “AIFi economy” and started its second phase of building its ecosystem.

You can think of Mode Network as an ETH Layer 2 that focuses on scaling DeFi to billions of users through on-chain AI Agents.

The Thesis. Mode claims that

“by 2026, more than 80% of on-chain TX will be via AI agents”.

People are underestimating the capabilities of A.I. agents. Probably because the 1st iteration of them is simply shitposting bots on Twitter.

However, some big brains such as Ryan Watkins or Teng Yan, believe A.I. Agents are pretty much going to take over the web. I’m 100% certain more and more transactions will be done by A.I. agents in the upcoming years.

The technology’s only been around for a few months. Can you imagine judging smartphones by their 1st iterations? I can see myself deploying A.I. agents one day to optimize yields, rebalance my portfolios, and find new gems on my behalf. One day I’m gonna go to sleep without a worry because my A.I. agents are taking care of my portfolio.

If we can trust “self-driving cars” with our lives, then we can eventually trust A.I. agents to handle aspects of our portfolios.

In a way, I’m betting on the intersection between AI x DeFi because this potentially opens the gate to tap into the TradFi market for Web2 users. And as far as I can see, Mode is in the best position to capture this market while DeFi has just recorded 0,002% of TradFi’s TAM so far.

|

A.I. Agents as the new “front end.” Everyone says that one huge barrier to Crypto adoption is we need better UX / UI. I don’t believe a prettier wallet is the solution. I’m imagining your everyday normie being able to issue commands through natural language, and the Agent executing on its behalf. That’s how we drive more adoption and simplify the experience.

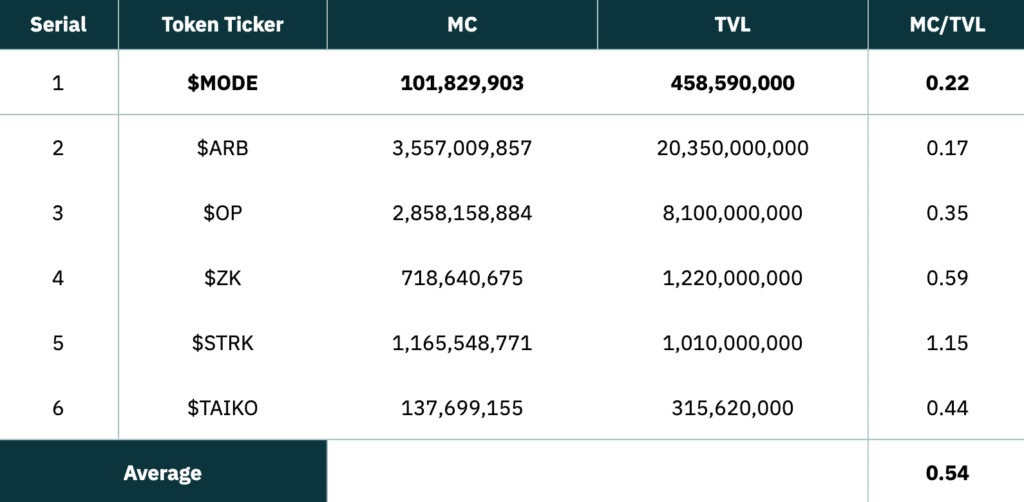

Price-wise, it’s at a market cap of ~$100m which I feel is extremely undervalued.

- You can base it on a comparison with other Layer 2s in terms of market cap to TVL ratio.

- Mode is an entire infrastructure powering DeFi x A.I. agents. While there are already some agents at the $100m market cap ($Bully is at ~113m for example).

And finally, I’m bullish on the team. It takes tremendous balls to completely pivot a network. Just read this post from October. The price has gone bananas since.

The Team.

- James Ross – Founder: Before founding Mode Network, James was the Managing Director and co-CEO of Hype Partners for years. During that time, he has advised leading blockchain ecosystems like NEAR, Polygon, or Dfinity on their go-to-market strategies.

- Nick Dijkstra – CPO: Nick now has almost a decade of experience in product management across both Web2 and Web3. Nick and James first started working together back in 2021 at Hype Partners, after James’s DeFi consultancy agency0x was acquired by Hype. During that time, they have built Hype to become the largest Web3 marketing agency with more than 170 headcounts.

Investors. Mode Network has raised a total of $5.41 million. The majority of this funding came from the Optimism Foundation, which granted Mode Network 2 million $OP tokens, valued at approximately $5.3 million at that time.

Why Mode Network is Interesting:

- Leading the intersection of on-chain AI agents and DeFi.

- The #3 biggest chain in the OP Superchain Ecosystem. It sits behind Base and OP Mainnet with a TVL of $458.59m.

- Synth, developed by Mode team, has just lived its testnet focusing on financial forecasting. It is one of 32 supported subnets by Bittensor.

- 40% of the total circulating supply is locked as veMODE for governance.

- No token unlocks until May 2025.

- A.I. Agent App Store – Mode Network is building out an “app store” for its A.I. agents and currently has 3 live agents.

- $MODE has grown nearly 200% in the last 30 days but it is still undervalued. To have a clearer picture, I make a comparison of the MC/TVL ratio among notable Layer 2 at the moment.

Notable Agents Built on Mode:

- Arma by Giza. An agent that helps you optimize USDC yields farming across Mode applications.

- Brian. Allow users to use natural language to execute transactions and deploy contracts at their fingertips.

- Sturdy. Leverage AI-powered Yield Bearing Vaults to aggregate and optimize returns.

- MODIUS by Olas. Allow you to co-own or launch your own AI Agent to optimize liquidity farming strategy.

Catalysts:

- Lately launched the first-ever AI Agent Hackathon in collaboration with ai16z, Olas, and Crossmint.

- FortyTwo – Mode AI Accelerator Program is going to launch its product, aiming to deploy natural language interfaces for on-chain apps.

- BitcoinOS Integration – Tap into $1.8T liquidity through the BOS Grail bridge.

Additional Resources:

- Mode: Building The AIFi Economy

- veMODE and veBGT Details Information

- AI Agent App Store

- Mode AIFi Accelerator Program

Disclaimer: This is my personal opinion and is meant to be educational. Please do your own research before investing.

🚀 DeFi Catalysts

Fluid and Pendle launched Fluid USDC and Fluid USDT (June 26, 2025) on Pendle. Users can now speculate on stablecoin yields on Fluid.

Drift Protocol introduced Drift Vaults. You can now access 20+ high-yield, pro trading strategies with one click.

Jupiter Exchange released JupiterZ. It uses a Request-for-Quote model that’ll give users gasless swaps and 0% slippage.

Fluid is launching its DEX on Arbitrum. They’ve published a proposal on the Arbitrum Governance Forum.

Usual Money and Ethena announced a partnership. Usual would use $USDtb as the primary collateral asset for Usual’s $USD0.

🚀 New Launches

Ink, the OP Stack-based L2 from Kraken, is now live on the mainnet. This launch is months ahead of the earlier schedule.

Sophon mainnet is live. It is a Validium built on ZK Stack and Avail that optimizes for intuitive end-user experiences.

Resupply has introduced a new stablecoin to replace Prisma. This stablecoin is created by rehypothecating $crvUSD and $frsUSD.

Dinero introduced $iETH. It’s an ETH liquid staking token (LST) for Kraken’s L2 Ink. It’ll be powered by LayerZero.

🐦⬛ X Hits

- Why did markets crash?

- Weekly update on Agent sector.

- Collection of all HyperLiquid reports.

- Data-driven analysis of Uniswap.

- How do based rollups work?