I caught up with some friends the other day. These were guys who were pretty hardcore into Crypto in the 2021 cycle. The thing is, they’re not in Crypto anymore. I asked them why not?

• They haven’t heard about any new innovations – Remember, last cycle had DeFi and NFTs as major innovations. We haven’t had a huge 0 -> 1 innovation yet (retail doesn’t care about another Layer 2).

• Prefer investing in A.I. stocks. So, they’re getting their dopamine money hits in a different way.

• Celsius / Luna / FTX burned them – this was the biggest one.

This can explain why “retail” hasn’t been back yet. It sucks to hear. I love Crypto, but I can understand their perspective especially if they’ve lost money.

We’re still dealing with a lot of the consequences of the previous cycle.

(By the way, I’m hiring a Research Analyst. If you want to research Crypto all day and get paid for it, apply here. Applications are due a week from now!)

Here’s what we got today:

- The Justin curse. Is WBTC losing credibility?

- Crypto watchlist. A starting point to build your own list.

- Around the web. Arbitrum is implementing $ARB staking, Polymarket mired in a controversy, AVS rewards are here, and more.

Today’s email is brought to you by KelpDAO — the DAO for $rsETH LRT.

Here’s your Edge 🗡️!

Analysis

Is WBTC Starting to Slip?

wbTC is a cornerstone of DeFi. It’s about to undergo a major change, and not in a good way.

(For the newbies, wBTC would convert Bitcoin into a “wrapped” version of that everyone could use on Ethereum)

What happened? In DeFi, wBTC is used as a proxy for BTC. Its Market Cap is $9.1B, sitting pretty at 13th place on Coingecko. BitGo, the company behind wBTC, used to hold the BTC that backs wBTC.

It’s changing in two months. Justin Sun, the founder of Tron, will have a significant stake in the new custodian.

Why does it matter? It changes the security status of a widely used asset in DeFi.

Justin Sun is an influential character in crypto. But he has been involved in many controversies.

His story with $TUSD is relevant here. Similar to the wBTC move, the control of the $TUSD stablecoin was moved to Justin Sun.

Things went south fast.

- Suspension of real-time proof of reserves.

- The previous management team jumped ships.

- Depegs caused by redemption service hiccups

And that’s not all. His other projects haven’t been scandal-free either. Take stUSDT, for example. It was supposed to be invested in US T-Bills, but onchain sleuths claimed that wasn’t really the case.

So yeah, people are right to be a bit jittery about this wBTC situation.

What could happen? If things go sideways, it could get ugly for wTBC:

- The market cap of wBTC might shrink.

- DeFi protocols might start distancing themselves from wBTC. MakerDAO is already discussing it. Remember, wBTC backs around 10% of DAI.

- A significant wBTC depeg could trigger liquidation cascades across DeFi, wiping out a ton of wealth.

There can be other second-order effects as well.

- This might be the perfect chance for alternative BTC wrappers to shine. Coinbase is launching cbBTC. And tBTC is also making some noise.

- As there aren’t many good alternatives, the security-minded segment of DeFi might swap from wBTC to stables or ETH.

Still, let’s not jump to conclusions. Is wBTC doomed? Not necessarily. We could argue that it’s too big to fail at this point.

$wBTC is deeply entrenched in the crypto ecosystem. Many protocols and people already accept it. It has deep liquidity. And let’s face it – there isn’t a good alternative either. The “Justin Sun threat” isn’t enough to topple these network effects.

BitGo is also saying that the underlying “technical security” won’t take a hit. Justin Sun won’t be able to move funds on a whim.

Just look at USDT—people have been skeptical about its backing for years, and they might have had a point. But guess what? It’s still the top stablecoin in the game.

Why? Liquidity and network effects. And $wBTC has a similar stronghold.

So, here’s my take: Unless wBTC depegs and sparks a massive bank run, it’s not going anywhere. This controversy? It’s just another bump in the road that’ll fade with time.

The good news is we’re now going to have more options such as cbBTC.

Sponsored By KelpDAO

Gain: The New Way To Boost Your Airdrop

Restaking is one of the top narratives in the space, and Kelp is the leading solution for liquid restaking. Just deposit ETHx or stETH into Kelp. In return, Kelp will give you rsETH, a Liquid Restaked Token.

But they’ve got more in store for you: Kelp is ready to take the airdrop crown. Forget the usual point system that only benefits whales.

Kelp have brewed something innovative.

Their newest launch, ‘Gain,’ offers easy access to diverse reward strategies, boosting your airdrop odds.

It’s a Vault program providing exposure to multiple airdrops through a single deposit.

How does this work? They’re essentially smart contracts that automate asset investment according to specific farming strategies.

Let me make it simple: With one click, you can access a risk-adjusted strategy to maximize yield and airdrop exposure.

By the way, Gain is non-custodial, meaning you can withdraw your money at any time.

How do you play it?

- You deposit one of the following assets—ETH, rsETH, ETHx, or stETH—into the Gain vault.

- You get agETH. This token represents access to their strategies.

- Your assets are automatically bridged to partner L2s like Linea and Scroll (maximizing your airdrop potential).

- The vault’s strategy manager, Tulipa, ensures your assets are allocated to achieve optimal returns, while partners like LayerZero handle the tech stuff.

1-click solutions make everything easier. You access several different L2 airdrops, save gas fees, and get a juicy yield along the way.

Ready to earn more with less effort?

Tool

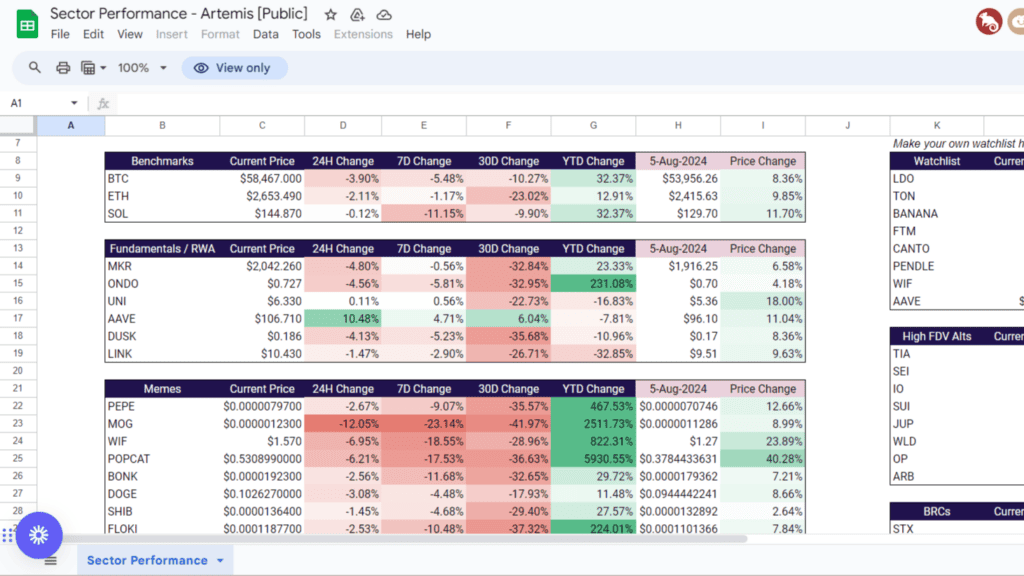

Crypto Watchlist: Which Tokens to Monitor?

There are thousands of crypto tokens out there, possibly even millions. Newbies can easily become overwhelmed. I mean, which tokens should you pay attention to?

Well… here’s a crypto watchlist from 0xKyle.

It’s a curated list that tracks major tokens across all major sectors and narratives. If you’re a newbie, don’t waste your time on random tokens found on pumpdotfun.

As this is a live watchlist, 0xKyle might keep updating it. In that case, you’ll be able to track 80/20 of the crypto price action just from this watchlist.

Using the watchlist is straightforward. Look at the performance data and trends. This will give you a snapshot of where each sector/narrative is heading. And how tokens within each sector is performing.

However, just following this watchlist is limiting.

- You won’t be able to find new gems from this spreadsheet.

- Looking at the actual price price chart might give you insights that these cannot.

- Doing a quick research on all the projects mentioned in the spreadsheet will give you an idea about the top projects in crypto.

The watchlist is best used as a starting point. Ultimately, the goal should be to build your own watchlist. It’s pretty straightforward.

- Pick the narratives/sectors you are interested in.

- Find the top projects for the narratives.

- And track them. Yaay. You have your watchlist.

You don’t have to build this in a spreadsheet. I use Dexscreener to create the watchlist.

But if you are a spreadsheet wizard, there will be many insights you can mine from a spreadsheet. In that case, Artemis Sheets is an excellent tool. You won’t have to collect crypto data from various websites. You can directly get the data you need into your spreadsheet.

Stay calm and keep analyzing – it’ll pay off.

🚀 DeFi Catalysts

MakerDAO got a new single-asset crypto investment fund for $MKR. It’ll be Grayscale MakerDAO Trust.

Arbitrum DAO is voting on implementing $ARB staking. As of now, >99% of votes are in favor of the proposal.

EigenLayer introduced AVS Rewards. It’ll allow AVSs to give rewards to the stakers and operators.

Polymarket has partnered with Perplexity AI. They’ll now add real-time probability predictions from Polymarket for queries about events like elections.

Spark, a subDAO of MakerDAO, started the Tokenization Grand Prix. They’re aiming to onboard $1 billion in tokenized real-world assets.

Ethena is live on Solana using LayerZero. It is already integrated into Kamino, Orca, Drift, and Jito.

NEAR Protocol launched chain signatures. It allows users to sign any transaction on any chain from NEAR, which will be huge for UX.

Balancer shipped CoW AMM. It is the first AMM that captures MEV and redirects it to Liquidity Providers.

RocketPool is voting on updating its tokenomics. As of now, >99% is in favor of upgrading the tokenomics.

Sei is integrated with Secret Network’s Confidential Computing Layer. It’ll add a privacy layer to the L1 blockchain.

Celestia‘s will have its first upgrade soon. The Lemongrass upgrade includes 1-click Tia interactions with other IBC chains, Interchain accounts, and a new upgrade mechanism.

🪂 Airdrop Alpha

Obol introduced the Obol Contributions program. Users can earn future governance tokens by staking with them.

Pencils Protocol launched the “Soul Drops“. Users can earn points for a future airdrop by completing quests.

Blast completed the Gold Distribution 2 of Phase 2 of its campaign. 11M Gold has been distributed across dApps.

Polynomial L2 is live. It has a native liquidity layer that is customized for scaling derivatives. And they’ve launched a points program as well.

Hana has launched its incentivized public quest on testnet. It is aiming to be the consumer-centric layer.

📰 Industry News

Polymarket is in a controversy over its decision on the Venezuela Presidential Election market. They didn’t declare the “official winner” as the president.

Optimism released the roadmap for a native interoperability layer across OP Stack L2s. It’ll address the issue of fragmentation among L2s.

Canto, an L1 chain, was halted after upgrading to v8. The funds weren’t at risk.

🚀New Launches

Vessel Finance, a ZK Orderbook exchange, launched on Scroll L2. they’ve also launched an incentive program for early active users.

Aleph Zero EVM is live. It is a specialized layer 2 built using Arbitrum Orbit that will bring EVM-compatible ZK-privacy.

Soul Wallet launched the v1 on Optimism. It’s a smart wallet for ETH L2s with features like social recovery and passkey signing.

🐦⬛X Alpha

- 10 reasons to be bullish about crypto.

- Great way to farm POWDER on the Mantle.

- Should Ethereum drop the ultrasound money meme?

- Big moves in the restaking sector.

- The Eth maxi thesis.