Bitcoin’s 15th birthday was on Halloween. Our little financial disruptor is old enough to drive now 😢.

Satoshi Nakamoto had published the $BTC whitepaper on Oct. 31, 2008. And that has now grown into a trillion-dollar industry.

The first recorded transaction on an exchange came in October 2009. Someone sent 5,050 Bitcoins to a new site called New Liberty Standard, receiving $5.02 in return.

In other words, one $BTC was equal to around $0.0010. Where’s that time machine when you need it.

Here’s what we got today:

- Unibot hacked. Users will compensated by the project.

- DeFi Dynamics. How fundamentals and pumpmentals affect prices.

- A DeFi Strategy. Introduction to delta-neutral liquidity looping.

- Around the web. Celestia airdropped around 60 million $TIA, Frax Finance’s domain was hijacked for around 6 hours, and more.

Here’s your Edge 🗡️!

Unibot Joins Hacked TG Bots List

It’s official: Telegram Bots have won the title for the least secure sector in all crypto. At this point, I trust my funds more with SBF than with a Telegram bot.

What happened? Unibot deployed a new contract on October 29th. And it was hacked on October 31st. Users lost a combined ~600k. The hacker is trying to hide the money via TornadoCash.

Could you have seen it coming? As a sector, Telegram bots have always played fast and loose with security. These bots have access to your seed phrase! Remember the golden rule: not your keys, not your coins.

All top three projects were hacked in some way:

- First, BananaGun had a bug in its contract and botched its token launch.

- Then, Maestro was hacked, lost ~280 $ETH, and had to spend ~610 to compensate victims.

- Now it is Unibot’s turn.

Although I had warned that most projects in this sector were risky, I was still surprised by the Unibot hack.

And even if you hadn’t seen this coming, considering the seedphrase situation, you should only have put an amount that you feel comfortable losing into Unibot.

For skeptical people, the red flags were there:

- The new contract isn’t verified on Etherscan.

- I couldn’t find the auditor for the new contract anywhere.

- Open source is the norm in DeFi. But UniBot isn’t.

What’s next? Since the team has reverted back to the old contract, the hack won’t affect you anymore. And they’ve announced that they’ll pay back everyone affected by the hack.

Edgy’s take: This constitutes a huge reputational hit for Unibot. But then, all the top Telegram bots have been hacked. So, its competitors aren’t doing any better. And since the niche likely isn’t going anywhere, I think Unibot has a chance to recover from this.

Even prices indicate recovery. Following the hack, the $UNIBOT token saw an immediate 42.7% drop in price in just one hour—from $57.56 to $32.94. But the price has now recovered to $44.

Despite the hack, I do think Unibot can recover from this. The amount lost isn’t large in the grand scheme of things, and they compensate people. They need to step up their security and show the changes they’re making.

People can forgive one exploit, but not two (Look at StarsArena)

The Yin & Yang of Prices: Fundamentals & Pumpamentals

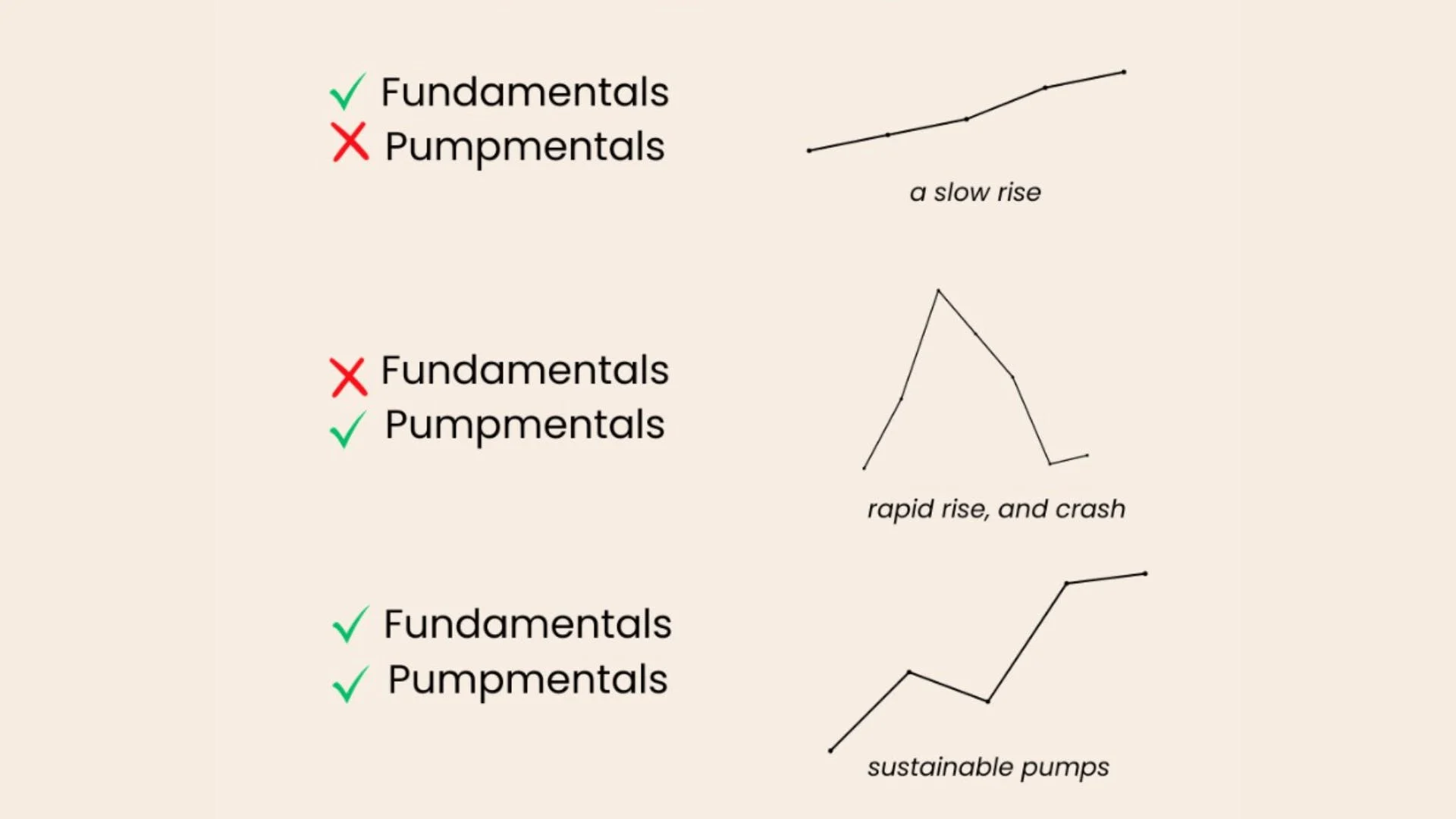

I want to share a common mistake I’ve seen mid’curvers make: they don’t understand the relationship between fundamentals and pumpmentals.

What are fundamentals? Fundamentals are factors that track projects’ intrinsic value. Do they have a working product? Does it generate revenue? What’s the TVL? Competitors? And so on.

In fundamental analysis, we consider if the project is undervalued or overvalued compared to its intrinsic value. But that’s not enough.

The token price will rise very slowly. And if the market is bad, we might see sustained bleeding. $UNI is such an example. Below is the $UNI price for the last 12 months.

What are pumpamentals? Crypto’s still speculative.

Token prices don’t go up unless other people buy. People won’t buy unless it’s on their radar. Sometimes I’ll see projects with great “fundamentals”, but no one’s ever heard of them. And the founding team seems clueless in the marketing department.

Pumpmentals include cult leaders, major influencers / vc’s backing, ecosystem funds, a fanatic community, and more. These are all elements that can gain attention to a protocol.

But pumpmentals alone also aren’t enough. Memecoins are perfect examples of projects that only have pumpmentals. They rise rapidly and then crash just as rapidly.

$PEPE is a great example of this. Here’s the $PEPE chart for its first four months.

So, ideally, we need both.

Pendle is a good example of this. They’re the best yield trading project, aka solid fundamentals. In 2023, they skillfully tapped into major narratives like LSDfi and RWA. So, they experienced sustainable pumps in 2023.

Here’s the formula: Fundamentals + Pumpamentals = Sustainable Pumps.

Are you interested in a tool that makes sure you are evaluating both fundamentals and pumpamentals?

Check out the DeFi 2nd Brain.

Delta-Neutral Liquidity Looping 101

I’ve always been obsessed with strategy.

I think it came from playing games like Age of Empires and Starcraft growing up. Having the right strategy just makes everything easier (compared to trying to zerg rush every game).

And this is the kind of mindset that I approach DeFi with. You have limited capital – you want to determine the best strategies to gain yield without as much effort and risk.

There are unlimited yield strategies out there. Today, I want to share a simple one so you can dip your toes in.

Before we get started, I want to share some beliefs with you.

- I believe in efficiency. The best strategies shouldn’t be ones that you have to monitor all the time.

- You have to consider risk. Each protocol and layer that you introduce adds another layer of risk (because if one layer gets hacked, everything goes to shet).

I’m going to share a delta neutral strategy with you, and share a practical example.

Delta Neutral Liquidity Looping (Using Stablecoin and a Lending platform)

- Begin by lending your selected stablecoin as security. (+yield from lending)

This will be your collateral. - Borrow a token for liquid staking, ensuring a conservative LTV ratio (advice is to keep it below 50% for safety). (-yield from borrowing)

- Transform the borrowed asset into one that is stakeable in liquid form. (+yield from staking rewards)

- Use the newly acquired liquid-staked asset as collateral. (+yield from lending)

- Continue the process, starting with securing a loan once more.

You want to stay Delta positive from the staking yield and lending compared with the borrowing costs in order for this strategy to work.

By having borrowed and lent your LST in this case, you are officially Delta Neutral.

Using this strategy, you are not exposed to price fluctuations.

Here’s a practical example:

- Lend USDC on Solend.fi (+2.84% APR).

- Borrow SOL (-4.64% APR).

- Stake SOL on marinade.finance (+9.07% APR).

- Lend your mSOL on Solend (+1.55% APR). Always sell your MNDE token.

You can keep doing that till your LTV is maxed out at a safe value.

Some benefits and downsides…

Protect your gains

- Convert generated yield to a safer asset.

- Convert the accumulated yield to your stablecoin collateral position.

- Allocate the generated yield to settle the borrowed amount.

Risks

- Stay alert and monitor any fluctuations in the value of the liquid-staked assets.

- Depeg of the LST to stakeable token.

- Monitor interest rates on the borrowed sum to ensure they remain within the return rates from staking (Delta positive always).

- Be wary of potential liquidation if the LTV escalates beyond the recommended maximum.

- General smart contract risks for all the parties.

Always adjust your strategy based on your personal risk management.

Please let us know if you enjoy this type of content. If you can use these strategies, feel free to share them with us.

🚀 DeFi Catalysts

Arbitrum is voting on activating $ARB staking for a 12-month period. As of now, pro-staking side is winning.

Swell Network introduced Super swETH. You can deposit stETH in this vault and earn up to 18% yield from staking + redirected DAO revenue.

Jito, the leading Solana liquid staking platform, introduced StakeNet. It’s a transparent and decentralized protocol for operating stake pools.

Ether.fi has scheduled the mainnet release of their liquid restaking token, eETH, for November 6th. Initially, it will be whitelist only.

Liquity Protocol‘s LUSD is now natively available on StarkNet. This expansion is made availble by Nimbora.

Zapper launches social app Chainchat on Base. It’s share-gated group chats that share fees from share-trading proportionately among holders.

Uniswap DAO has voted in favor of investing 3 million UNI (~$12MM) in Ekubo Protocol. The DAO will receive 20% of Ekubo’s future gov token.

StarkNet has allocated 50 million STRK tokens for the Early Community Member Program. If you’ve contributed to the community, you can apply.

Landslide Network is building the IBC light client for IBC light client that’ll connect Cosmos and Avalanche ecosystems. Its testnet is open.

Vertex Protocol announced $VRTX Liquidity Bootstrapping Auction from Nov 13th to Nov 20th. It is their mechanism for launching $VRTX token.

PancakeSwap introduced Position Manager for PancakeSwap v3. It introduces features like automated LP and auto-compounding rewards.

ApeCoin DAO voted to create a platform to enable the required infrastructure for ApeCoin powered payments and rewards for games.

📰 Industry News

Celestia mainnet is now live. They airdropped 60M TIA tokens to active users on Ethereum L2s, Cosmos and Osmosis stakers, and crypto developers

Solana Breakpoint, their conference, is going on in Amsterdam. There might be bullish announcements related to the ecosystem.

Arbitrum Orbit is now mainnet-ready. It allows devs to create layer-3 chains on top of Arbitrum L2s permissionlessly.

Frax Finance domain name was hijacked for ~6 hours. The website directed users to a fake website. We don’t about any loss of user funds yet.

SnowTrace, a blockchain explorer for Avalanche, will shut down its Etherscan-powered explorer. Speculators are blaming Etherscan fees for the close.

ZachXBT is advising degens to be careful about De.Fi‘s $DEFI token sale. They haven’t distributed tokens to the IDO that happened 1.5 years ago.

🧠 Twitter Alpha

- Vitalik Buterin: different types of L2s.

- Fed Meeting for the first time since September 20th.

- Highlights and questions from the latest Tether report.

- Zuckerberg email from 2008. “Move fast and break things.”

- Surfing the $ARB incentives, a strategy from Louround.

- Who is buying American treasury Debt?

😂 Meme