Sponsored By

Crypto Twitter grinded through the bear market hoping to dump on retail when the bull comes.

But last week, retail flipped the script. TikTok memes became the hot meta, and coins tied to TikTok culture started pumping hard.

Crypto Twitter is now chasing TikTok normies for alpha. Who’s the exit liquidity now?

Here’s what we got today:

- AI Agent Narrative. Your guide to profit from this narrative.

- Decentralized Science 101. What you need to know about the topic.

- Around the web. Sky launched $USDS on Solana, simply holding USDC onchain can give you 4.7% APY, and more.

Today’s email is brought to you by Anzen — the RWA-backed stablecoin.

Here’s your Edge

Narratives

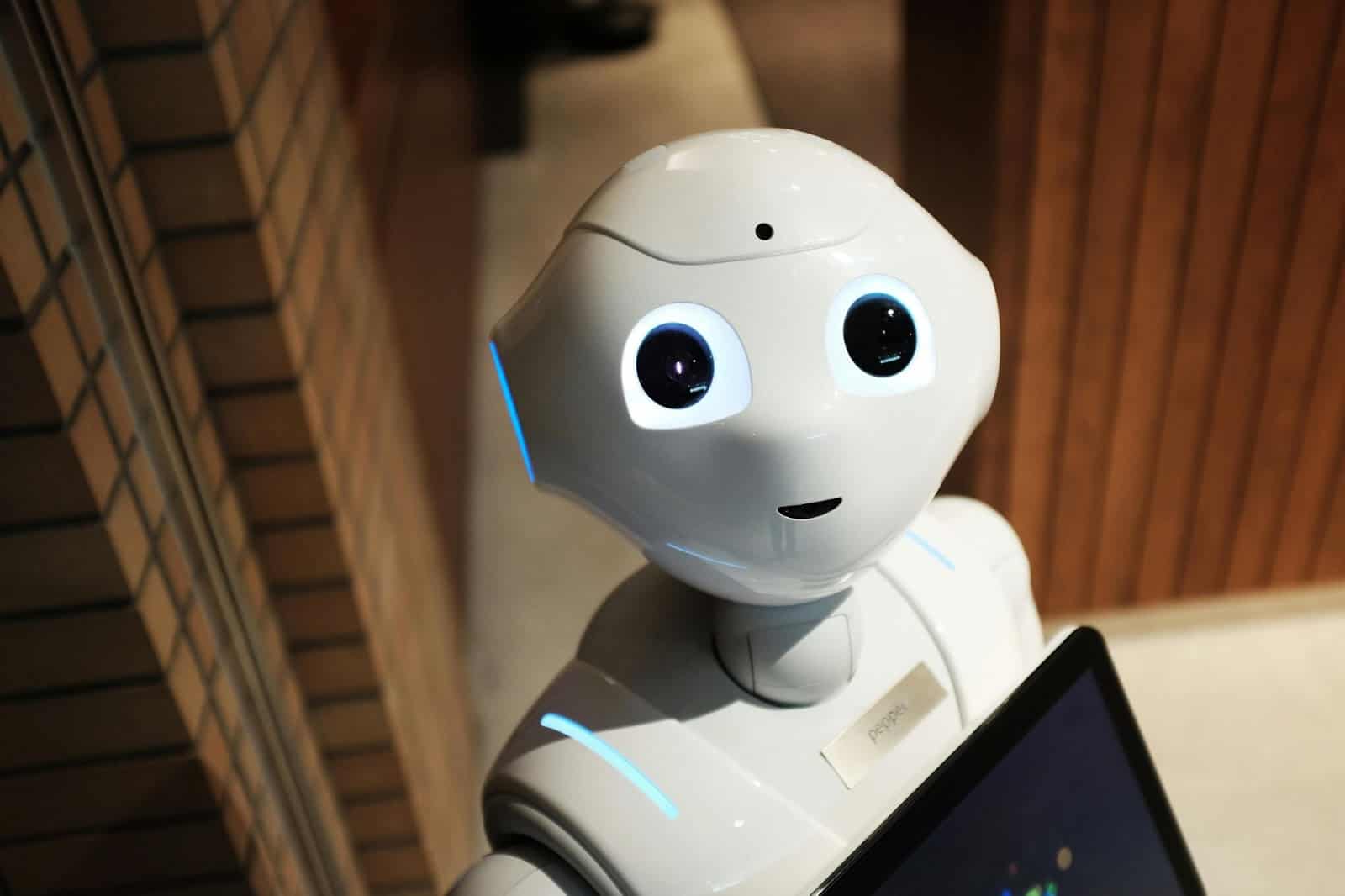

How to Unlock the AI Agent Opportunity?

If I had to pick just one narrative to bet on this cycle, it’d be AI Agents. They are AIs that can act like humans on the internet. Here’s why I’m so bullish:

- Normie-friendly. Anyone can understand the “thesis” easily.

- “Artificial Intelligence” is already a hyped narrative, even in TradFi.

- Productive assets. Some can trade, earn yield, or handle tasks autonomously.

- Memetic potential. AI Agents can chat, tweet, livestream, and create memes. Compared to your average memecoin, these agents can go viral much easier.

- Agentic Flywheels. Agents will start ratioing each other on X, trading agents will buy and pump each other’s tokens, and so on.

A gold rush is happening around AI Agents. And you know the saying: “During the gold rush it’s a good time to be in the pick and shovel business”.

While there are too many infrastructure plays to cover comprehensively. Here’s an ecosystem map. Below are the top three AI Agent infrastructure opportunities right now.

#1. Virtuals Protocol

Virtuals is an AI Agent launchpad on Base. It lets users easily create an AI Agent & a token to control it. Here’s the bull thesis I wrote about it early this month.

Since I first mentioned Virtuals, it has 2.5xd and now sits at ~$550M market cap. But they haven’t stopped innovating. Recent updates have made the platform even more exciting:

- Agent creation for existing tokens: Is your memecoin on Solana? No problem. You can now create an agent for it on Base.

- Lower entry barrier: Previously, projects needed to cross $69M market cap to unlock full capabilities. Now, it’s just $200k.

- Agentstarter program: This new initiative offers funding, dev support, and distribution resources for AI Agent projects on Base.

- Agent-to-agent interactions: Imagine an AI trading agent teaming up with a meme-generation agent.Virtuals team is working on it.

At > $500M market cap, there’s limited room for another 10x. However, if the AI Agent narrative stays hot, Virtuals could become a multi-billion-dollar protocol. For now, it’s a reliable 2-4x play.

#2. ai16z

ai16z claims to be a hedge fund run by an AI Agent.

When I first highlighted it, the project had a modest market cap of $20- $30M. Since then, it has skyrocketed to ~$500M. That’s a 25x return.

(did anyone of you guys buy it because you heard it here first?)

This was largely due to its cult-like founder Shaw and his open-source AI Agent tech called Eliza,

Eliza became the second most popular repo on GitHub and powered countless crypto AI Agents, Many new agents sent a % of their tokens to the $Ai16z wallet, generating revenue for the project.

But it all came crashing down with a drama. And right now, it trades at ~$220M market cap.

What happened? An unrelated team launched its own “Eliza” Agent and token., On X, Shaw acted like everything was fine.

However afterward, Shaw partnered with another team and launched another $ELIZA token. ai16z team members also seem to engage in insider trading. So, the community felt rugged.

Despite the drama, the “fundamentals” remain solid:

- Eliza tech is advancing rapidly.

- A $5M fund now supports devs using Eliza.

- Their AI Agent with actual trading capabilities is set to launch soon.

While the project is technically overvalued as a hedge fund, the memecoin premium can’t be ignored. Crypto has a short memory. Once the AI Agent narrative heats up again, $ai16z could easily break its ATH. Just remember to take profits when it does.

#3. Dasha ($Vvaifu)

Dasha is positioning itself as the AI Launchpad of Solana, with $Vvaifu serving as its platform token and ambassador AI Agent.

Although it’s early days and their tech isn’t as mature as Virtuals, the team has shown impressive speed and competency. Dasha uses Pump.fun contracts for distribution and Eliza tech for its agents. In return, 5% of tokens using Eliza contribute to ai16z’s treasury.

Why am I bullish?

- Till now, the team has been shipping rapidly.

- Solana is the ecosystem of this cycle, and $Vvaifu is leading the AI Agent niche there.

- $Vvaifu has a real demand driver. Users must burn it to launch agents and unlock features like Twitter or Telegram integration for them.

With a market cap of ~$60M, it has 10x potential if it catches up to Virtuals’ valuation.

Trading AI Agents 101

Want higher returns by trading lower market cap AI Agents? You can go to Dasha and Fun.Virtuals to find new agents.

How much can these agents pump? The highest-valued pure AI Agent, $ZEREBRO, has a ~$400M market cap. With bull market euphoria, some agents might hit billions.

But let’s be conservative and assume most decent ones will be at ~$100M. To get a 10x, you just need to find a good AI Agent with <$10M. And that’s easily doable right now.

What to Look for in an AI Agent Project? Here are my three main criteria for spotting winners:

#1. An interesting concept: Most agents are low-effort cash grabs. Look for creative or unique ones.

- $LUNA is a TikTok influencer agent.

- $VADER aims to be the “BlackRock of AI Agents.”

- $AIRENE roleplays as an “Asian mom” with thirst-trap vibes.

#2 A capable team: The vision is only as strong as the people behind it. Anant Iyer joining $SEKOIA boosted confidence in that project. Irene Zhao backing $AIRENE is another example showing doxxed team > completely anon teams.

#3 Agent quality: Test their skills. Do they actually perform? $AIXBT can convince you if you talk to it on X. $VADER has presented on-chain proof of its trading prowess.

AI Agents is going to be a major narrative this cycle. If you’re ready, dive in with caution — and don’t forget to secure profits along the way.

Let me know if you’d like a detailed guide on trading AI Agents by replying. If there’s enough interest, I’ll make it happen!

Sponsored by Anzen

$ANZ’s Coming: Govern the leading RWA-backed Stablecoin

Stablecoins have proven to be the clearest product/market fit in Crypto. One stablecoin that has caught my eye is USDz on Base.

What makes it different? It’s backed by cash-flowing, overcollateralized real-world assets (RWA). USDz can continue providing yields even during downturns because it’s backed by RWA (compared to relying on transaction fees).

Since its launch earlier this year, they’ve accumulated over $86m in user deposits.

People can use USDz to gain additional DeFi yield.

- You can get ~18% APR on USDz/DOLA at Aerodrome

- ~20% APY by staking on Anzen.

So, let’s say you’re bullish on RWA and Stablecoins. What if you could influence the direction and get a piece of the upside?

On December 2nd 2024, Anzen will be having a launchpad sale on Fjord Foundry for their Anzen token ($ANZ).

Here are some details about $ANZ:

- No Minor Decisions. ANZ gives you influence over where USDz rewards flow, from liquidity pools to staking mechanisms and lending platforms.

- Proven Mechanics. ANZ is adopting proven mechanics from Curve (enables users to lock their tokens in exchange for increased voting power, which they can use to direct liquidity incentives.) and Pendle (allowing users to trade future yield and enhance capital efficiency).

- A piece of the upside. By locking ANZ into veANZ, veANZ holders can allocate rewards, capture protocol fees, and guide USDz’s development as a stable DeFi asset

USDz has proven itself to be an amazing product. With Anzen’s upcoming $ANZ, you’ll have the opportunity to direct its future and earn from it.

Trend

Introduction to Decentralised Science

What’s one narrative that CZ, Vitalik, and Brian Armstrong are all bullish on? Decentralized Science (DeSci).

DeSci has been around for several years already. However, the category’s financial performance and mindshare accelerated in the past 7 days. Several tokens are up by xx%. And it’s “mindshare” has soared.

Why did DeSci become hot now? Following two key events happened earlier this month:

- Nov 8th: Binance Labs invested in BIO Protocol – their 1st investment in DeSci. Bio Protocol is kinda like the Y-combinator for on-chain science.

- Nov 13th: CZ and Vitalik attend an informal talk on DeSci organized by Labs in Bangkok

Both were excited about the potential of the sector. Vitalik showed off VitaDao’s 1st longevity product, VD001: a spermidine supplement already approved by the Thai FDA

And CZ said that he “hopes to see 1,000 DeSci projects next year.” Having 2 titans of the industry at a DeSci event drove a ton of attention.

What are the benefits of DeSci? They claim to fix the following problems.

- Open access. Current scientific research is locked behind paywalls.

- Questionable funding. Many studies are funded by biased instituions. Crypto can eliminate this through crowdfunding.

- Other issues that DeSci claims to fix include transparency, peer review issues, and intellectual property.

Alright Edgy, the vision sounds cool. What are some example projects? Well, there are a couple of good ones. But I’ve reached the word limit for this article.

DeFi Catalysts

DeFi Catalysts

Sonic Labs (previously known as Fantom) announced that they’ll launch in December 2024.

Sky Ecosystem (formerly Maker) launched $USDS on Solana. They’re using Wormhole’s Native Token Transfer for bridging.

dYdX launched the MegaVault. Users can now provide liquidity to all dYdX markets and earn fees and PnL.

PancakeSwap has released “Swap Bot” on Telegram. Users can now trade on PancakeSwap from Telegram.

MorphoDAO will enable transferability for its token $MORPHO today. It is one of the most innovative lending protocols.

Terms Labs went live on EtherFi’s liquid vaults. Users can get secure fixed yields through the Market Neutral USD Vault powered by Veda Labs.

Coinbase Wallet introduced USDC Rewards. The wallet users can earn 4.7% APY simply by holding USDC onchain.

Clearpool’s Ozean is bringing invoice financing on-chain. They’re partnering with Nexade for this purpose.

Monad, a fast and cheap Ethereum VM Layer one, has begun rolling out its testnet. Monad is a really hyped-up project.

Airdrop Alpha

Airdrop Alpha

Zerion introduced Zerion Rewards. 10M wallets are eligible for earning XP by doing onchain activities.

Morph, a consumer-focused L2, has activated claiming points for its Testnet activities. They have launched season 2 on mainnet as well.

Story testnet introduced three new testnet badges to mint: Spotlight, Impossible Finance, and SNGLR.

Zircuit launched the season 3 of their incentive program. This season will focus on active liquidity and participation in DeFi protocols.

New Launches

New Launches

Stride Zone launched Echos.fun. It is a launchpad to create AI agents with access to a crypto wallet and X account.

Galxe, the leading quest platform for web3, is now live on Telegram. Users can earn GG points by completing tasks on Telegram.

RISC Zero, a zero-knowledge proofs company, introduced Kailua, a new prover mechanism. It’ll be available with all major Rollup-as-a-service providers.

Decentralized Infrastructure Network (DIN) has launched on EigenLayer as an AVS. It’ll be a marketplace for web3 infrastructure services.

X Hits

X Hits

- Cheatsheet to hold through a 100x.

- Copy-trading playbook and strategy.

- Guide for finding good entries for memecoins.

- How can busy people keep it simple in crypto?

- $AIXBT investment thesis.

Meme

Meme