Hey real quick.

I sent you an email last week. Some people let us know that gmail flagged it as “this message seems dangerous.” Thanks everyone for letting us know.

- Our accounts were not compromised in any way.

- We triple checked all the links and can verify none were dangerous.

Sometimes Gmail has more stringent policies regarding Crypto links, and flagged a link as suspicious. Anyways, we’ll do more tests before we send emails out in the future. Sorry for the alarm.

– Edgy

Here’s what we got today:

- Fantasy.top 101. Is this the next friend.tech?

- VCs vs Retail. Our take on the ongoing drama.

- Around the web. Friend.tech launched v2 and their token, Mode Network started season 2 of their points program, and more.

Today’s email is brought to you by Swell – a staking + restaking protocol.

Here’s your Edge 🗡️!

The Biggest SocialFi dApp since Friend.Tech

Friend.Tech took over the Crypto hivemind when it first launched. And now, the next big SocialFi App is here.

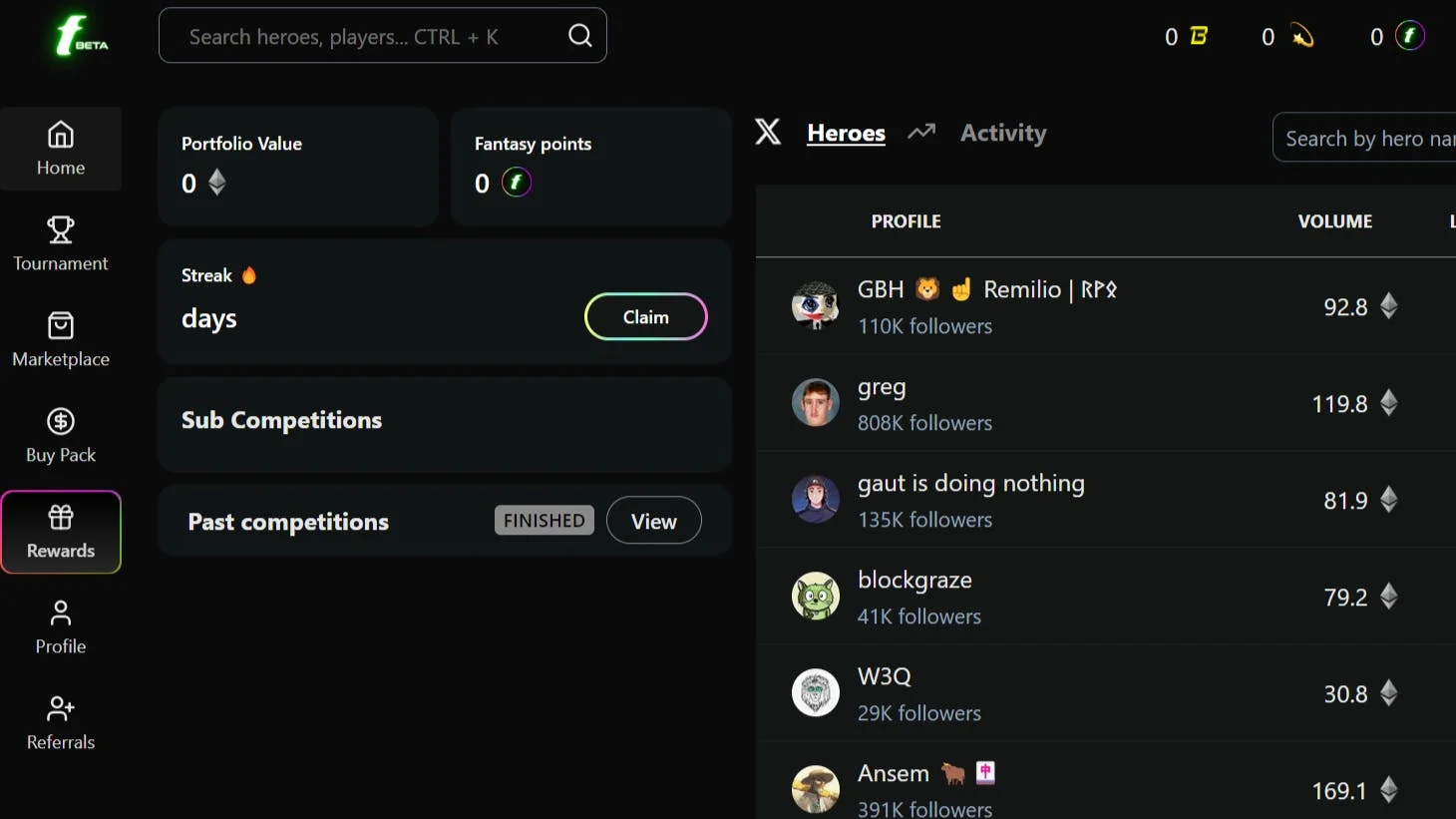

What is Fantasy.top? It’s a trading card game. Think of Pokeman’ish cards based on your favorite Crypto Influencers.

Users are able to buy cards of other X users/influencers. Or buy a pack of influencers cards. You then create a team of five heroes and register in tournaments using these cards.

Winners are decided by the total points gained by all five heroes. Points are based on X activity and the engagement of respective cards.

This game is already getting adoption on a massive scale. Let’s look at some numbers:

- It had 33,794 users in the last week.

- USD 789.5k $ in total marketplace fees.

- Around USD 26.3 million $ in total trading volume.

- Influencers (heroes in the game) have earned ~USD 1.4 million $ in the last four days alone. See the chart below.

You can see more metrics on this dashboard.

Why is it so popular?

Several factors are working in favor of Fantasy Top:

#1 Excited customers. The market’s choppy and everyone’s sooooo freaking bored. This launched at the perfect time.

#2 It is an actually fun game. Many people are already familiar with trading card games like Pokemon. I used to play those when I was younger. And Fantasy.top actually feels very similar.

Crypto-natives spend too much time on X anyway. This game is a way to make it productive. Plus, it is fun to watch influencers compete against each other.

#3 Leverages influencers for growth. Friend.tech has tried to leverage influencers for growth. But the incentives weren’t fully aligned between users, card issuers, and the protocol.

In Fantasy.top, the incentives are perfectly aligned between users, influencers, and protocols:

- Users/card traders want to buy cards from their favorite influencers.

- Influencers are intrinsically motivated to improve their X engagement. This boosts their points. So, users and influencers are perfectly aligned.

- The platform is giving money to influencers whose cards are used in competitions. So, influencers are happy.

- The protocol wants more traders and influencers on their platform. So, they’ll keep shipping features to make Fantasy.top more attractive.

#4 Rewards and points. Some people have already made huge money trading Friend.Tech tokens, while some are now hoping to make similar amounts from Fantasy Top.

Influencers will get a share of revenue from:

- The 1.5% fee of the trading volume of their card.

- The 10% of pack sales which is split equally across heroes.

- Free editions of their own card.

Users can also win rewards from competitions. They can get ETH, Blast Gold, FAN Points, and free packs from these competitions. The protocols might add more rewards later.

#5 It’s at the intersection of several trends/narratives.

- Everyone is always waiting for a good SocialFi app. And this seems to fit the bill for now.

- There are very few good crypto-native games. Fantasy.top is the top GameFi protocol right now.

- The Blast will probably drop their token by the end of May. This is likely going to attract a ton of attention to Blast. Fantasy.top is the top dApp of the Blast ecosystem.

Edgy’s take

I wasn’t too excited about Friend.Tech when it first launched, but Fantasy.top has some serious potential.

I could list a bunch of reasons why, but ultimately it just seems fun. You’re combining trading card + gambling elements (opening packs) + everyone’s bored right now.

If they can keep the momentum up, this could be a breakout app of the year.

What’s interesting is seeing how different people are trying to game the system. I’ve already heard that some people are using bots to boost their favorite influencers. Whereas some influencers are turning up the engagement baiting to try and go viral.

Are you interested in checking it out?

Step 1: Go to Fantasy.Top

Step 2: You need a tiny amount of eth to enter. Like .001 ETH worth (~$3USD).

Step 3: You need an invite code to get in. Sign up and type in “thedefiedge” to get access when they ask.

Sponsored By Swell

Farm Multiple Airdrops with One Deposit

Imagine depositing an asset and becoming eligible for several airdrops and getting a 4x airdrop boost and higher yields.

That’s what Swell L2 is offering.

Swell is a staking and restaking protocol. It issues both swETH and rswETH. With its Layer-2, you can reap all of the above-mentioned rewards.

When you deposit into Swell L2 pre-launch, you get:

- Airdrop eligibility (ION, Brahma, Ambient, and more)

- 4x pearls if you deposit swETH or rwsETH

- One extra $SWELL airdrop in Q3

You can deposit a wide variety of tokens. And you retain any points and yield for deposited assets. For example, if you deposit USDe (from Ethena), you continue to earn Sats.

Swell is positioning itself to become the leader in the restaking space. Swell L2—the L2 for restaking—promises to offer fast transactions, cheap gas, and greater DeFi opportunities by plugging straight into EigenLayer AVS’s.

Deposit in the Pre-Launch now →

What are Venture Capitalists up to now?

Some people think of VCs as the smartest guys in the room.

Others think they’re degenerates like us…except they have access to more money and capital.

Regardless, they have plenty of power and clout in this space. It’s always interesting to see what they’re up to and to see if there are any interesting trends.

Galaxy Research released an interesting report regarding the current status of VCs.

Activity has risen when compared to the prior two quarters.

One key data element is that investments from funds usually strictly follow market sentiment. But this seems to differ this time around.

We’re still far away from 2021-2022 levels of VC investment.

Some more interesting data from the report…

- Early-stage deals are leading the way. Funds are looking for new shiny things.

- Bitcoin L2s generated the most interest.

With the introduction of Ordinals and new DeFi solutions, BTC has definitely been on many investors’ radars.

- Web 3 and Trading have seen a lot of flow, but in Q1 2024 infrastructure is leading in terms of the number of deals and capital raised.

- New funds increased, but the average AUM shrank by 40%.

VCs and meme coins

We have probably all witnessed the recent memecoin mania. The meme market has seen explosive growth.

The optics has always been that retail investors love memecoins, while VCs focus on large infrastructure protocols.

But one thing has surprised us even more: some fund managers are allocating small sums of their money to memes.

Memecoins are easy to create and trade, with decentralized finance exchanges seeing heightened activity in this space.

Meanwhile, tokens have also begun to trade more on mainstream exchanges.

This shift is mainly due to memes taking a less strict tokenomics approach towards users.

What can feel like a jungle may have made sense to Brevan Howard.

According to Bloomberg, the macro hedge fund recently invested a tiny bit of its capital into memecoins.

So, 2024 gave us hedge funds investing in memecoins. What else can we expect for the rest of the year?

🚀 DeFi Catalysts

Velodrome, a DEX on the Optimism chain, will begin deploying across the OP Stack L2 chains. The first deployment will be on Mode Network.

Gearbox shipped Friendly leverage. It reduces the probability of liquidation and lowers losses during liquidations.

Perpetual Protocol introduced Nekodex, a mobile-focused DEX with no gas fees, no wallet app, and no signing for each trade.

Silent Protocol introduced the Ghost Layer. They are calling it “Layer 1.5”. And it’ll provide compliant privacy for public blockchains like Ethereum.

Solv Protocol announced a partnership with Babylon, a $BTC restaking protocol, to bring restaking yield to SolvBTC.

Sturdy Finance, a modular lending protocol, deployed Sturdy Subnet on Bittensor mainnet. The miners will be competing to create best asset allocation algorithms.

Osmosis plans to roll out “alloyed Bitcoin”. It’ll be a basket of variants of BTC such as nBTC issued by Nomic, wBTC issued on Ethereum, and Osmosis’ native wBTC.

Axelar Network introduced the interchain amplifier, an interoperability tool. Stacks, Moonriver, Hedera Network, and Iron Fish have joined a devnet-phase pilot program.

Aave introduced many major upgrades and expansions. These include Aave V4, Aave Network, Cross-Chain Liquidity Layer, non-EVM L1 deployments and a fresh new visual identity.

🪂 Airdrop Alpha

Suilend Protocol introduced Suilend Points. 10 million points will be distributed per day. The points will be onchain as well.

Friend.tech airdropped $FRIEND to users. They also launched its v2 on May 4th. The reactions have been lukewarm.

Mode Network completed season 1 of the points program and started the season 2. $MODE from S1 is now claimable.

EigenLayer is allocating 100 more $EIGEN to all users who had interacted before April 29th. They’re also aiming to enable transferability by September 30th.

Dymension‘s $DYM stakers are getting many airdrops. Here’s a list of all the airdrops associated with $DYM stakers.

Saga‘s Vault One airdrop claim is live. The claim will close on May 15th.

📰 Industry News

FTX creditors are set to receive 118% of their funds back in cash within 60 days of court approval. This is higher than earlier estimates.

Heroglyphs, a protocol for incentivizing solo validators on Ethereum, has published its website.

Robinhood‘s crypto division received a Wells notice from the SEC. Its stocks had fallen up to 7% after the announcement.

🐦⬛ X Hits

- Fees generated by SocialFi app in the last 7 days.

- The dump guide from Koroush.

- Rules for meme coins.

- This is not a shitpost.

- Current DeFi opportunities.