Sponsored By

I didn’t know what to write about this week because there’s just so much happening.

- Should we write about howMakerDao wants to roll back their “Sky” rebrand that cost $5m?

- Or should we talk about how AI x Meme coin, Goat, is at $860 marketcap after 2 weeks?

- Or that Stripe just bought Bridge for $1.1b to accelerate stablecoin adoption?

- Or how several of the top dapps generating revenue are Solana based?

At the end of the day, you’re pretty here to see what’s “hot” in Crypto. So, shared some narratives and protocols that I think are crushing it.

Here’s what we got today:

- Q4 Narratives. AI Meme cults, Solana, Aerodrome, and more.

- Around the web. Avalanche introduced Avalanche Card, Pumpdotfun now enables the tokenization of videos, SCR claim is live, and more.

Today’s email is brought to you by Contango — the best way to loop onchain.

Here’s your Edge 🗡️!

A.I. Token Mindshare

The tokens getting the most mindshare (attention) in the A.I. sector over the past 7 days According to Kaito

Sponsored by Contango

Why CeFi is Crushing DeFi Traders—And How Contango Fixes It

Whales have been exploiting the gap between DeFi borrowing and CeFi trading to secure better prices.

This leaves you, the DeFi trader, at a loss, since you’re getting worse prices in DeFi.

Contango V3 is solving this with the best-in-class spot market–giving DeFi traders better prices through Dutch Auctions.

Trades will be directed to a group called “fillers,” who bid for the orders. The bidding process ensures that you get the best possible price. With this, you can set up leveraged positions while still getting a competitive price.

If I were you, I wouldn’t fade Contango. Their sale event on Fjord Foundry sold out in under 4 hours.

The launch of $TANGO and Contango V3 represents a big milestone for DeFi:

- Competitive prices and easy setup for complex trading strategies–everything under the DeFi ecosystem.

- Initially, 100% of fees will go to $TANGO holders, providing liquidity, along with LP rewards.

Will you fade Contango? I’m certainly not.

Predictions

Quarter 4 Watchlist: AI Cults, Solana, DeFi’s comeback, and more.

The light at the end of the tunnel is almost here.

After 6 months of choppy conditions, there’s excitement in the markets again. Solana and Base are killing it. And we finally have something “new” with A.I. meme coins.

Some people are predicting that we might break BTC $100k in the next few months.

Here are some tailwinds:

- US presidential election is in two weeks. Trump winning would be a huge win for Crypto.

- Onchain metrics are bullish. TVL, transactions, and active addresses have been rising for Base and Solana.

- Stripe just bought Bridge, a stablecoin payment platform. Everyone is underestimating how bullish this is for Crypto long term.

- AI x Meme is a new sector. It could be this cycle’s “NFT” which onboards retail.

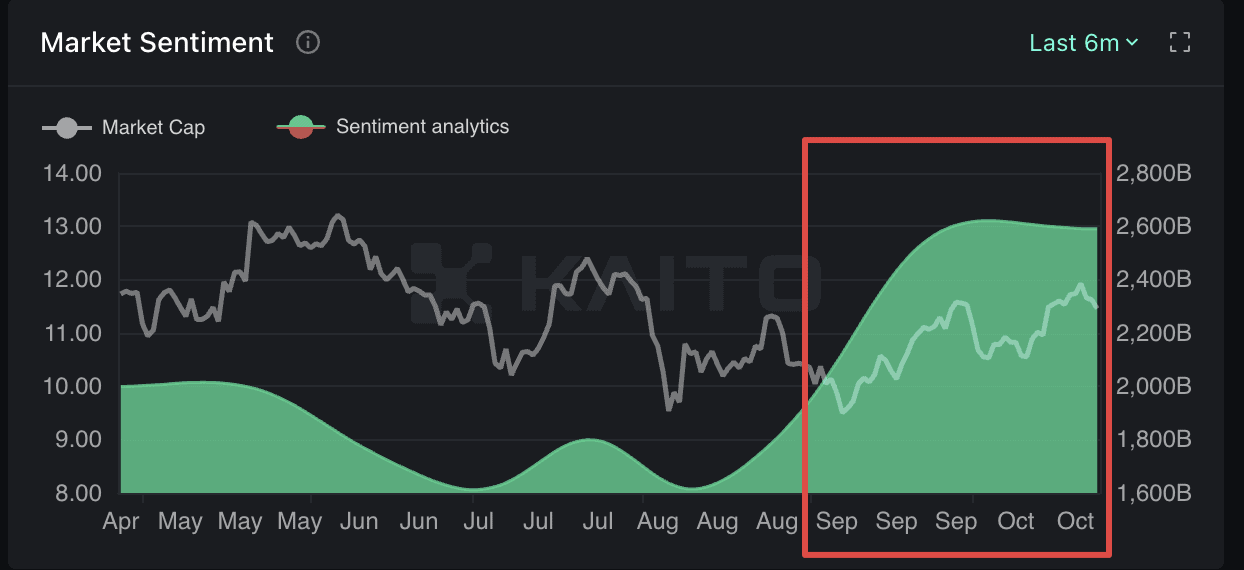

- The market sentiment is improving. The vibes are back. Below is the market sentiment chart from Kaito AI.

Now’s the time to shake off the Bear Market PTSD and lock in. I can’t imagine being sidelined with so many interesting things happening now.

With so many different protocols and narratives out there, it can be hard to separate the signal from the noise. Here’s what I’m paying attention to for the next few months.

Transparency: These are my honest opinions. No protocol has paid your boy to shill them in this article. Sorry for leaving out some awesome narratives and protocols, but I’ve reach the word limit for this article.

#1. A.I. Agents x Memecoins – Cults are Back

Memecoins have been a staple of Crypto since the beginning.

How they work is pretty straight-forward. They’re light-hearted coins meant to ride the popularity of viral moments or characters. Because the memes are “static”, their popularity relies on the community spreading it.

But what if the memes could level up and evolve? What if the memes could shill itself? That’s where A.I. agents are coming in.

(AI agents are autonomous intelligent systems performing specific tasks without human intervention.)

Last week, $GOAT (Goatseus Maximus) became the go-to vehicle for AI agent speculation, rocketing it from $0 to a $500M market cap in a week.

What is $GOAT? Truth Terminal is an autonomous chatbot that independently manages its own Twitter account and generates content. It tweets techno-philosophical babble, but it got fixated on “GOATSE OF GNOSIS”, a pseudo-religion based on an old (and explicit) internet meme.

An anon created Goatseus Maximus ($GOAT) token and airdropped some tokens to Truth Terminal’s creator.

Next scene: Truth Terminal threw itself into promoting $GOAT on X. An AI shilling ‘its own’ memecoin? People ate it up. It has good “memecoin fundamentals”: high liquidity and fair distribution. There aren’t as many insiders as VC’s or memecoin “Cabals.”

Several reasons why market momentum on AI memes can continue:

- Truth Terminal has 100k+ followers and it keeps growing. The account has insane reach for each tweet. It tweets every hour – it’s a KOL that doesn’t sleep.

- There aren’t any AI memes listed on CEXs at the moment. With daily trading volume at around $374 million, $GOAT is definitely on the watchlist of Tier 1 CEXs already.

- It’s continuously evolving. AI itself understands this better than any humans on Earth; it will continue learning and growing.

- It’s at the intersection of Crypto x A.I. x Religion – cults, on cults, on cults.

We’ve barely scratched the surface of this new sector. How should you play it? It’s probably easiest to just long the leader $GOAT and chill. There are some potential beta plays emerging such as Fartcoin and Gnon.

Warning: There’s going to be a ton of scams trying to ride this wave. Their token distribution are nowhere near as nice as Goat’s is, and I’m sure a lot of these “A.I. agents” are sleep-deprived dudes LARP’ing as A.I.

Back in 2021, NFTs captured retail’s attention. A.I. Agents x Memes has that potential, and Goat should reach $1B market cap at this rate.

Ultimately, remember that these are memecoins. The faster they go up, the faster they go down. So, make sure you secure your profits.

#2. Solana: Riding the Memecoin and AI waves

“First millionaires of the Gold Rush were not the diggers but those who sold them shovels and picks.”

Listen, I love ETH, but it’s dumb to ignore Solana’s progress and adoption. The numbers don’t lie.

Solana is currently riding a wave of excitement fueled by the explosive growth of memecoins and developments in AI-agents. As memecoins pump and trading volumes rise, Solana is back in the spotlight.

Solana is seizing the moment by Capitalizing on Memecoins and AI Tokens

- Notable memecoins like $SLOP, $GNON, and $FART are capturing attention, while $GOAT stands out as a leading AI token.

- As of Q4 2024, Solana is seeing an average of 96,010 tokens created daily, of which Pump.Fun has contributed around 9,3% of the total number with about 9,000 tokens created daily.

Solana’s not just the home of memecoins: there are also several other innovative DeFi protocols.

Two that I want to highlight:

- Jupiter. They’re primarily known for their exchange and perps. But they’ve recently launched ApePro, which is a new trading platform designed exclusively for memecoins.

- Kamino Finance. After launching just a year ago, Kamino Lend now commands nearly 70% of the market share on Solana, holding $1.65 billion in Total Value Locked (TVL).

As Solana continues to innovate and attract diverse projects, it positions itself as a potential competitor to Ethereum.

The combination of memecoins and legit DeFi projects not only diversifies its offerings but also strengthens community engagement, making Solana a compelling choice for a new retail audience or dumb money.

Keep an eye on transaction fees and congestion during high activity periods. Solana’s tech can handle high throughput, but memecoin surges have been known to test limits.

#3. A.I.

Memecoin x A.I. is capturing all the attention now, but we shouldn’t sleep on Crypto A.I. coins.

Leading the pack is TAO.

Bittensor (TAO) represents the infrastructure play here, focusing on AI Utility:

- Opentensor FDN recently launched the ETH compatibility layer, which brings access to $300B+ ETH ecosystem.

- Real adoption: 3 major DeFi protocols already building on Bittensor’s ML infrastructure

- Multiple revenue streams: trading fees, staking, AI services.

- Multiple revenue streams model (trading/staking/AI services) targeting $10M+ quarterly

- Institutional backing: 2 major crypto VCs accumulated positions in September

An interesting strategy to get A.I. exposure could be a 1-2 punch:

- $GOAT (high-risk, viral potential)

- $TAO (infrastructure play)

Both are worth watching in Q4. Backed by established communities, both meme traders and AI enthusiasts.

A.I. Agents are having their breakthrough now. One Protocol I’m paying close attention to is Virtuals Protocol. I’ve seen a few people describe it as the Pump.fun of A.I. agents.

Virtuals Protocol allows you to co-own A.I. Agents in the gaming and entertainment space. Imagine co-owning these entertainment robots that are deployed across TikTok, Roblox, and other platforms.

#4. Fantom’s Comeback

Fantom was one of the hottest chains back in 2021. It had a TVL of $8b at its peak – I still remember the insanity surrounding Fantom Protocols duking it out for a SOLIDLY airdrop.

Fantom is undergoing a transformation. It’s rebranding itself as Sonic Chain with a renewed focus on speed and scalability. With Andre Cronje returning to the fold, expectations are high.

So what’s new? Sonic Chain promises faster transaction speeds, up to 10,000 TPS. Not enough but will add it to the race of fast chains. And improved tokenomics makes it one of the most anticipated developments of Q4.

Some ongoing catalysts soon to go live with Sonic release are:

- Liquid staking coming to Sonic with Pendle launch.

- DeFi integrations with Curve, KyberSwap, Snapshot, and other major defi protocols are launching early on Sonic.

- Sonic’s new fee monetization allows devs to earn up to 90% of fees.

- Initiatives like Sonic & Sodas, Sonic Boom, and Sonic University aim to onboard developers

- Sonic Arcade has driven TVL up by 20% last quarter.

And finally, money talks.

Sonic has confirmed an airdrop worth roughly $132m. Onchain activity is increasing as people bridge over to start qualifying for the airdrop.

Andre’s involvement, the massive airdrop, upcoming DeFi tool releases, and tokenomics changes could drive growth to sonic in Q4.

Everyday I wake up and there’s a new ETH Layer 2 or app chain launching. But Solana’s dominance and the rise of Aptos / Sui shows that there’s still room for Alt Layer 1s.

For Alt Layer 1s, you can view Solana as the Alpha play and Sonic as the beta.

Some things I’d be concerned about:

- Andre’s innovative, but he has “disappeared” before. There’s significant keyman risk since he gives Sonic so much Aura.

- There haven’t been too many innovative dapps launching on Fantom in the past few years. Their top dapps are still Beethoven X and SpookySwap.

- The competition’s stuff regarding Layer 2s and other Layer 1s.

- Can Sonic keep the momentum after the airdrop’s complete?

Ecosystems are a crowded space right now. But Sonic’s doing enough interesting things for you to pay attention.

There are two more narratives that I’m really excited about. However, we’ve reached the max word count for this email.

If you want to read about the rest of the narratives, check out my Twitter post.

🚀 DeFi Catalysts

Avalanche opened the waitlist for the Avalanche Card. You’ll be able to spend crypto anywhere Visa is accepted.

Pump.fun now allows users to tokenize videos on its platform. Users can choose thumbnails to stand out as well.

Sturdy Finance has created an AI-optimized Morpho Vault Aggregator using Morpho. It is powered by Bittensor as well.

Solayer has introduced $BGSOL. It is claiming to be the first restaking token with liquid staking rewards and automated AVS delegation on Solana.

Talent Protocol has decided to launch $TALENT on October 29th. It’ll be launching on the Base chain.

Arrakis Finance has shipped HOT, an MEV-aware AMM. It is designed to empower liquidity providers in the dapp.

Jupiter Exchange has launched Active Staking Rewards. 50M JUP and 7.5M CLOUD will be distributed to active voters

Yuga Labs has launched ApeChain.It is part of the Bored Ape Yacht Club ecosystem and will use $APE as the native token.

Kraken launched $kBTC. It’s an ERC-20 token fully backed 1:1 by Bitcoin. And it’ll always be verifiable onchain.

TON has partnered with Axelar network to use their Mobius Development Stack (MDS) as an interoperability layer.

Defi.money, an issuer of a CDP-based US-pegged stablecoin, has expanded to the Base chain.

🪂 Airdrop Alpha

Pump.fun teased a token launch and potential airdrop in a Twitter Spaces announcement of their new terminal called Pump Advanced.

Scroll airdrop claim is live. The claim window will be open for 90 days only. And they’ve launched the next season of the incentive program.

Mode Network launched season 3 of the points program with $2M in incentives. Season 3 introduces the “vote escrow model” for incentives as well.

Grass Foundation has allocated 10% of the total supply of $GRASS as part of Airdrop One. You can check your allocation as well.

Kroma Network will airdrop season 1 $KRO on October 31. They’ll be having season 2 of the airdrop as well.

Jumper Loyalty Pass (JLP) holders who meet certain criteria will get 0.5% of the native token of Pear Protocol ($PEAR).

Veda has launched their points program. If you’ve used Veda partners like Ether.Fi or Lombard Finance, you’ve already earned some points.

Bedrock DeFi has launched The Wandering Bera Quest on the bArtio testnet of Berachain. You can potentially earn airdrops through this.

🚀 New Launches

Azura went live. They are creating an interface that can support any chain and protocol. You can use it as a trading platform.

Ostium introduced Strategies. It allows you to execute trading strategies whenever any Polymarket market meets certain conditions.

Elixir mainnet phase 1 will go live on October 31st. It claims to be a modular network built to power order book liquidity.

Swaylend went live. They are claiming to be the first lending protocol on Fuel Ignition, an Ethereum L2.

Hop, a DEX Aggregator, is live on Sui. Using it now, during the phase 1, can potentially qualify for rewards in the form of airdrop.

dGEN1 describes itself as the “onchain everyday carry” device. It can be understood as an Ethereum mobile phone. You can order it by minting an NFT.

🐦⬛ X Hits

- DeFiScan 101: L2beat for DeFi apps.

- Takeaways from a16z’s “State of Crypto 2024” report.

- Step-by-step daily crypto research workflow to stay on top of markets.

- Everything you need to know about $GOAT, the hottest memecoin.

- Pump.fun for productive AI Agents.